The Cayman Islands’ financial services industry is even more important to the economy and government finances than earlier figures suggested, according to new research.

An independent study by Capital Economics reveals that the sector generated CI$2.5 billion in gross value added (GVA) in 2023, accounting for 44% of all domestic economic activity. Once indirect and induced impacts are included, the industry supports 62% of Cayman’s total economy, up from earlier estimates of around half. Indirect impacts come from financial services businesses spending their revenue on local suppliers, while induced impacts are generated by employees in the sector spending their wages in the local economy.

The report shows that for every additional dollar spent in the financial services industry, another 91 cents is generated through suppliers and local consumption, amplifying the sector’s impact.

Preliminary results from the economic impact study show the fiscal impact is also greater than previously understood. In 2024, the sector generated CI$510 million in direct government revenues, accounting for 45% of the total, compared with 42% just two years earlier.

Including indirect effects, in terms of activity produced in other sectors, the industry generates CI$734 million, equal to almost two-thirds (65%) of all government revenues, making it the single most important pillar of public finances.

“These findings show that financial services do even more for Cayman than many realised,” said Steve McIntosh, CEO of Cayman Finance, which commissioned the research. “The financial services industry is not just the largest driver of government revenue and economic output, but also an engine of opportunity for Caymanians, especially women.”

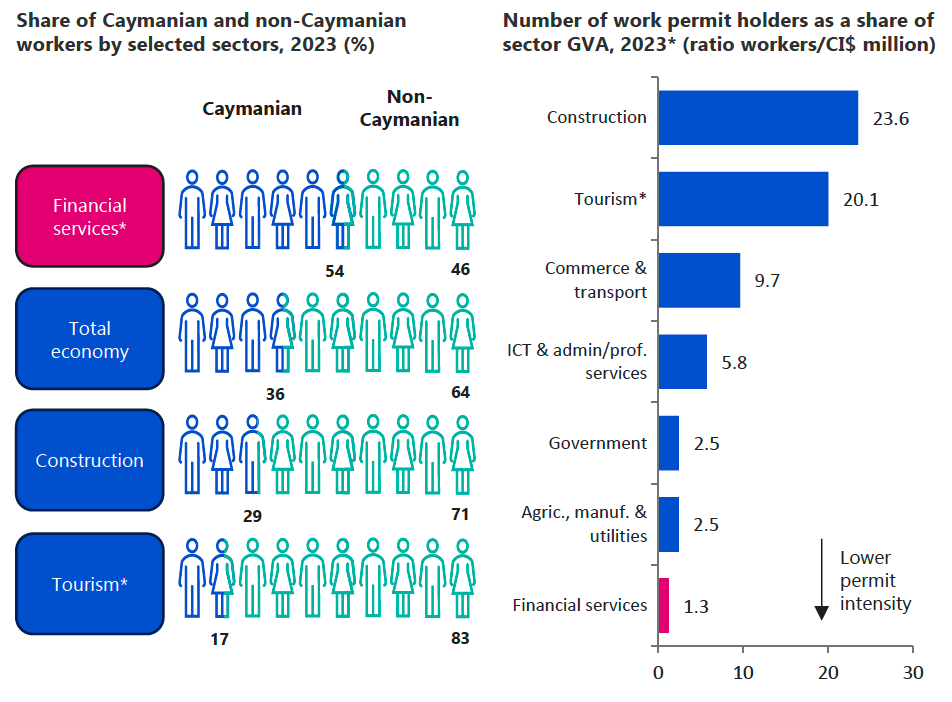

The report also highlights the financial services industry’s strong local employment, as about 54% of the 6,724 financial services jobs are held by Caymanians, compared to just 29% in construction and 17% in tourism. The sector is the Islands’ largest employer of women, with nearly 60% of its workforce female. Around one in five women in the workforce is employed in the sector.

Despite its outsized economic and fiscal contribution, the industry relies on a comparatively small number of expatriate workers, with just 2,800 work permit holders in 2023, far fewer than, for example, in construction and tourism.

“Financial services deliver extraordinary value for Cayman and are central to the Islands’ prosperity,” McIntosh added. “Our industry delivers more with fewer expatriate workers than any other sector, while remaining deeply committed to developing Caymanian talent.”

The full report will be released by the end of September.