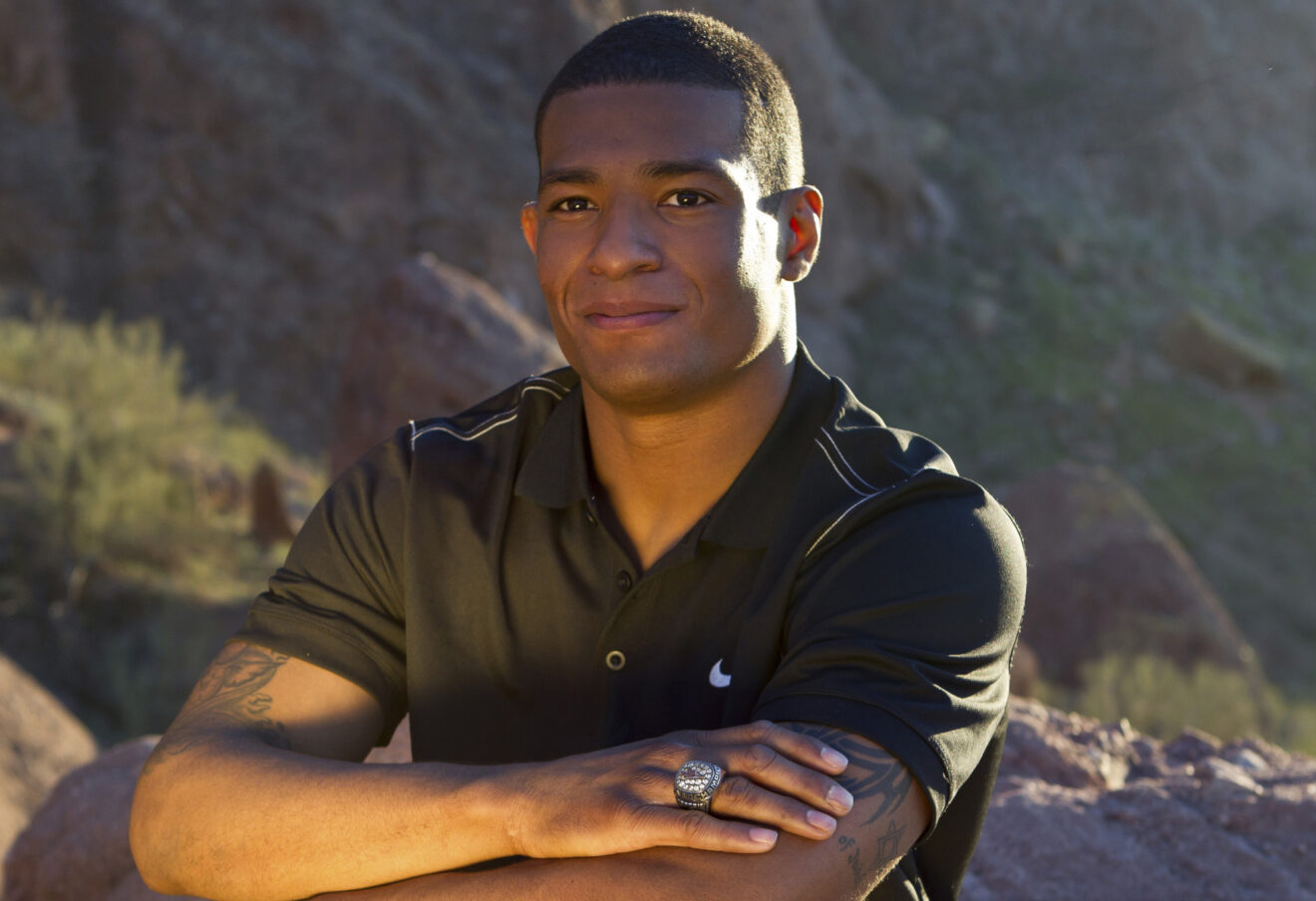

Chris Duncan

Carey Olsen has welcomed four newly-promoted Cayman Islands corporate lawyers to the partnership. They are Chris Duncan, Trevor McCabe, Jenna Willis and Dylan Wiltermuth.

The four promotions bring the total number of partners across the Carey Olsen group to 78.

Carey Olsen Cayman Islands managing partner Nick Bullmore said in a press release: “These well-earned promotions come at a particularly exciting time for Carey Olsen in the Cayman Islands, which is making impressive progress in terms of both market share and market standing. Chris, Trevor, Jenna and Dylan have each demonstrated impressive technical knowledge and commitment, to the benefit of their clients and to Carey Olsen.”

Chris Duncan leads Carey Olsen’s fintech and digital assets teams across the Cayman Islands and the British Virgin Islands, having joined the firm in 2019. He is one of the few Cayman and BVI dual-qualified advisors in the fintech space, advising institutional clients to startups on the full spectrum of fintech, crypto and digital assets matters. With a background in litigation and regulatory investigations, Duncan also regularly helps clients navigate requests and investigations from local and foreign regulators and authorities.

Trevor McCabe joined Carey Olsen in 2020 from an international law firm in Dubai, where he advised on a full spectrum of international transactions for financial institutions, companies, sovereign wealth and private equity funds. He has a wealth of experience in general corporate and corporate finance work, including equity offerings, IPOs, joint ventures, private equity work and cross-border mergers and acquisitions. McCabe’s counsel is regularly sought by emerging growth technology companies and venture capital firms in cross-border venture financings, mergers and acquisitions, and public and private capital markets transactions.

Jenna Willis joined the firm in 2019 from a magic circle firm in London. She advises clients on a broad range of banking and finance transactions as well as general corporate, commercial and regulatory matters. Willis is an expert on financial restructurings, having advised on numerous complex cross-border restructurings, refinancings, distressed M&A, security enforcement and high yield bond restructurings.

Dylan Wiltermuth joined the firm in 2017 and has extensive experience in all aspects of corporate work, having spent many years advising clients on complex cross-border transactions across a wide range of jurisdictions. He advises on joint ventures, IPOs, mergers and acquisitions, and also on capital markets and structured finance transactions. Wiltermuth maintains a strong focus on public company work, private equity, financial services and energy spheres. He recently advised payments giant Visa on its $1 billion acquisition of Pismo.