- 17,722 private funds registered in Cayman in 2025, up from 12,695 in 2020

- Cayman is home to more than 30,000 funds, including 12,875 mutual funds

- Cayman funds hold US$16 trillion in assets under management as the largest offshore funds domicile

Cayman Finance reports continued growth in the jurisdiction’s private funds sector, following the publication of the 2025 Fund Statistics by the Cayman Islands Monetary Authority (CIMA).

The number of private funds domiciled in the Cayman Islands has increased by 430 year-on-year to reach 17,722 at the end of 2025. This represents a 40% increase since the end of 2020, when 12,695 were domiciled in the jurisdiction, following the introduction of the Private Funds Act, which mandated registration, annual audit requirements, and formalised oversight mechanisms for valuation and custody.

Cayman’s fund sector has expanded rapidly in recent years, in step with growing demand for private credit fund-raising. As banks retreated from middle-market lending post-2008, private credit managers filled the funding gap with bespoke financing solutions. Private equity also remains foundational to Cayman’s fund sector, but structures have continued to evolve, particularly through the increased use of continuation vehicles and other hybrid approaches that combine primary commitments, secondary purchases and co-investment rights.

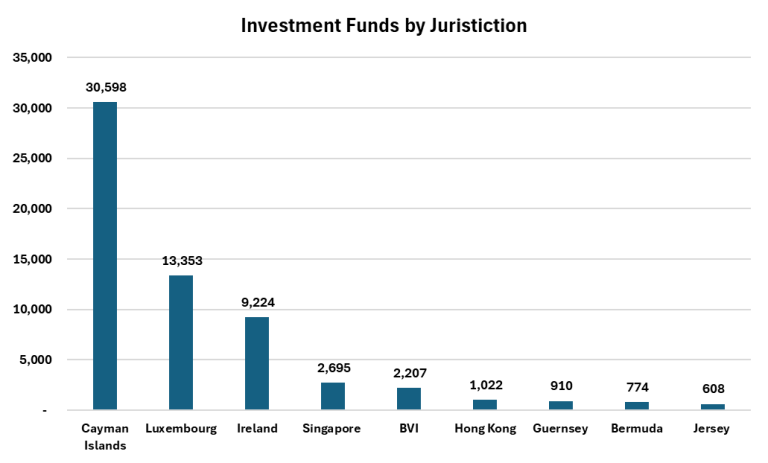

The jurisdiction is now home to 30,598 funds, including 12,876 mutual funds. Hedge funds are typically registered as mutual funds under Cayman’s regulations. Cayman funds managed US$16 trillion in total assets at the end of 2024, with a net asset value of US$9.1 trillion, consolidating its status as the world’s leading offshore domicile. Data from the US Securities and Exchange Commission shows the jurisdiction accounts for approximately 32% of US private fund net assets.

Cayman funds are also popular in Japan, where institutional investors hold over $645bn in overseas allocations, with approximately 80% of those funds flowing into Cayman-domiciled funds. In terms of net asset value (NAV), Cayman funds with investment managers in the UAE have seen a 200% year-on-year increase from 2023 to 2024, from $26 billion to $78 billion. Cayman funds, which are managed by investment managers in Brazil (22%) and Singapore (21%), have also seen significant growth in net asset value.

New fund registrations softened slightly in the final quarter of 2025, as global private equity fundraising conditions remained challenging amid fund de-registrations that typically occur at year-end. This moderation has been partly offset by renewed demand for hedge fund strategies. The size of the global hedge fund industry increased by about $628bn in 2025 to exceed $5tn, according to HFR. Cayman hosts more than 75% of the world’s offshore hedge funds, with 54% of all net assets reported to the SEC being managed in Cayman-domiciled funds.

Samantha Widmer, Director and Head of Funds & Capital Markets at Cayman Finance, said: “Cayman’s fund sector has recorded strong year-on-year growth as it cements its position as the domicile of choice for investment managers. The latest figures reinforce what we’re seeing across the market. Cayman combines tax neutrality and English common law certainty with a robust, commercially practical regulatory framework. Since the introduction of the Private Funds Act, the jurisdiction has strengthened institutional confidence through consistent oversight, while still delivering speed to market through streamlined processes and a deep bench of experienced service providers.”

She added: “As private credit, continuation vehicles and hedge fund strategies continue to evolve, Cayman’s flexibility and global credibility position it to support the next phase of investment growth. Virtual asset strategies and tokenised funds present new structural opportunities, with Cayman already hosting approximately 58% of crypto and digital asset hedge funds globally.”