Unaudited financial results of the Cayman Islands’ core government for the first six months of 2025 show that total government revenues of $766.3 million were $51.5 million higher than in the same period last year.

Coercive revenues, those derived from fees, licenses, duties and other taxes, have grown by 8.2% ($55.1 million) year on year.

However, government expenses have risen even faster by $60.7 million.

Compared to the budget and its financial forecasts created in 2023 for the two-year 2024/25 budget period, the half-year results represent a $194 million budget surplus.

Such large budget surpluses are the norm in the first six months of the year, when most financial services fees are collected. In the second half of the year, expenses significantly surpass revenues, to the extent that even a large initial surplus could still turn into a deficit.

Core government’s surplus to date is $7.1 million smaller than last year, and the surplus for the entire public sector, which includes statutory authorities and government companies, is $14.9 million less than in the first six months of 2024.

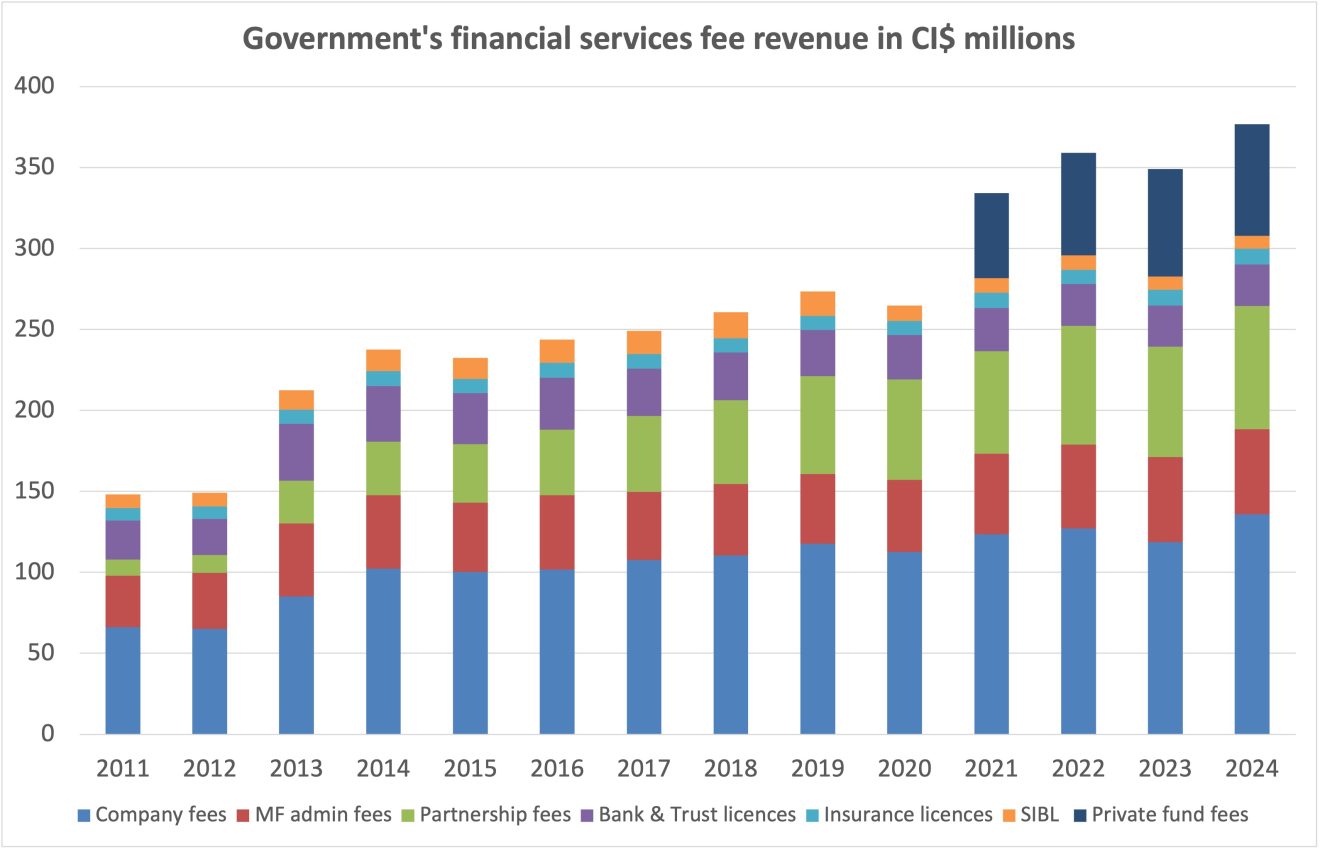

Financial services fee revenue

Government’s overall revenue and the increase over last year are mainly the result of financial services activity and, in particular, financial services fee increases, which took effect in January of 2025.

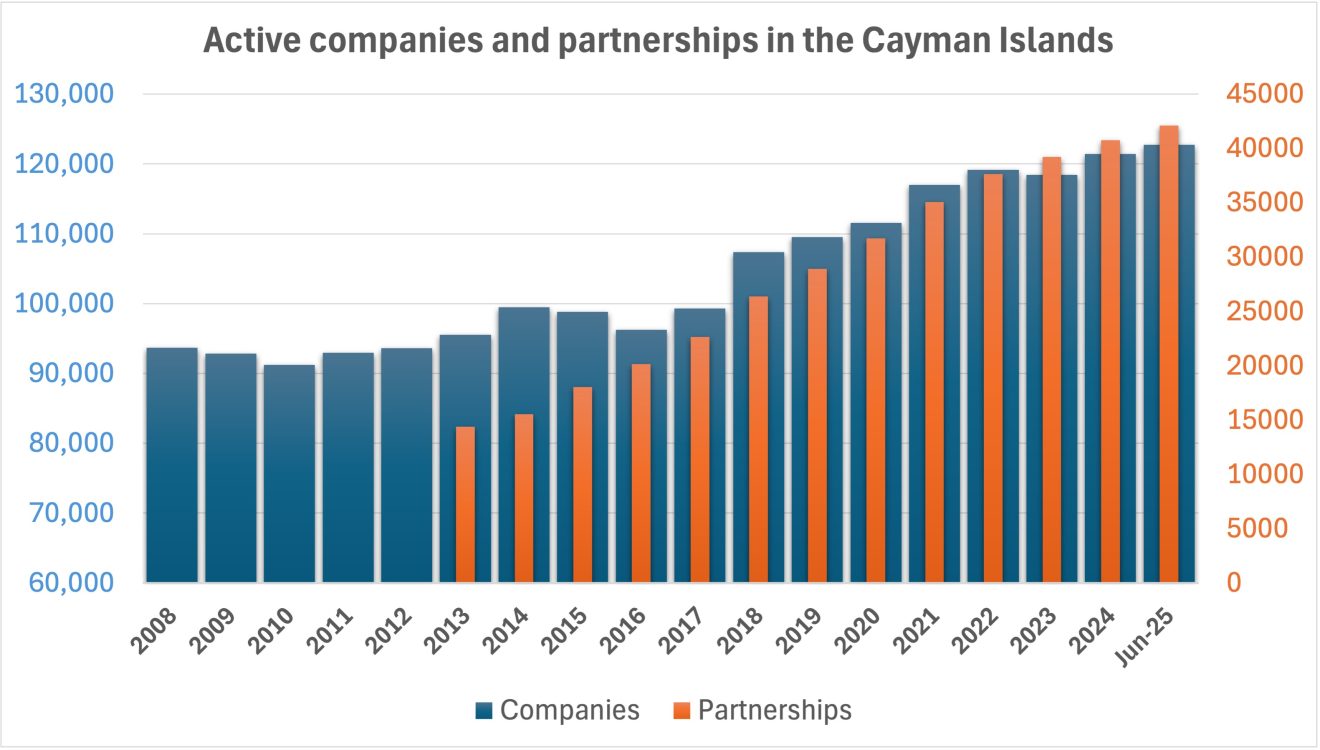

Exempt company fees alone brought in $17.1 million more than during the same period in 2024. The number of active companies has grown from 121,449 at the end of 2024 to 122,733 in the second quarter of 2025. During the first six months, 6,440 new companies were incorporated in Cayman.

However, fee increases generated most of the positive variance, with company fees going up by about 10% this year.

Government similarly increased partnership fees at the beginning of 2025 and collected $8.9 million more from partnerships than during the first half of last year.

The revenue growth was supported in part by a growing number of active partnerships, which jumped from 40,763 in December 2024 to 42,104 in June.

Collected private fund fees, another important revenue line item, were $6.6 million higher than in the same period in 2024.

Company fees (18%), mutual fund and private fund fees (16%), partnership fees (10%), as well as bank, trust, insurance and securities business licenses (6%) together make up 50% of the core government’s total revenue for the first six months in 2025.

This does not include any work permit fees or import duties paid by financial services firms.

Government expenses

On the expenditure side, total government spending on salaries and benefits for civil servants has increased by more than $25 million over the past 12 months, albeit $8 million less than budgeted.

Unexpected expenses in the form of transfer payments increased by $17.5 million compared to last year. This included $9.9 million more than budgeted on financial assistance, $9.1 million more on scholarships and $2.6 million extra on payments to seamen.