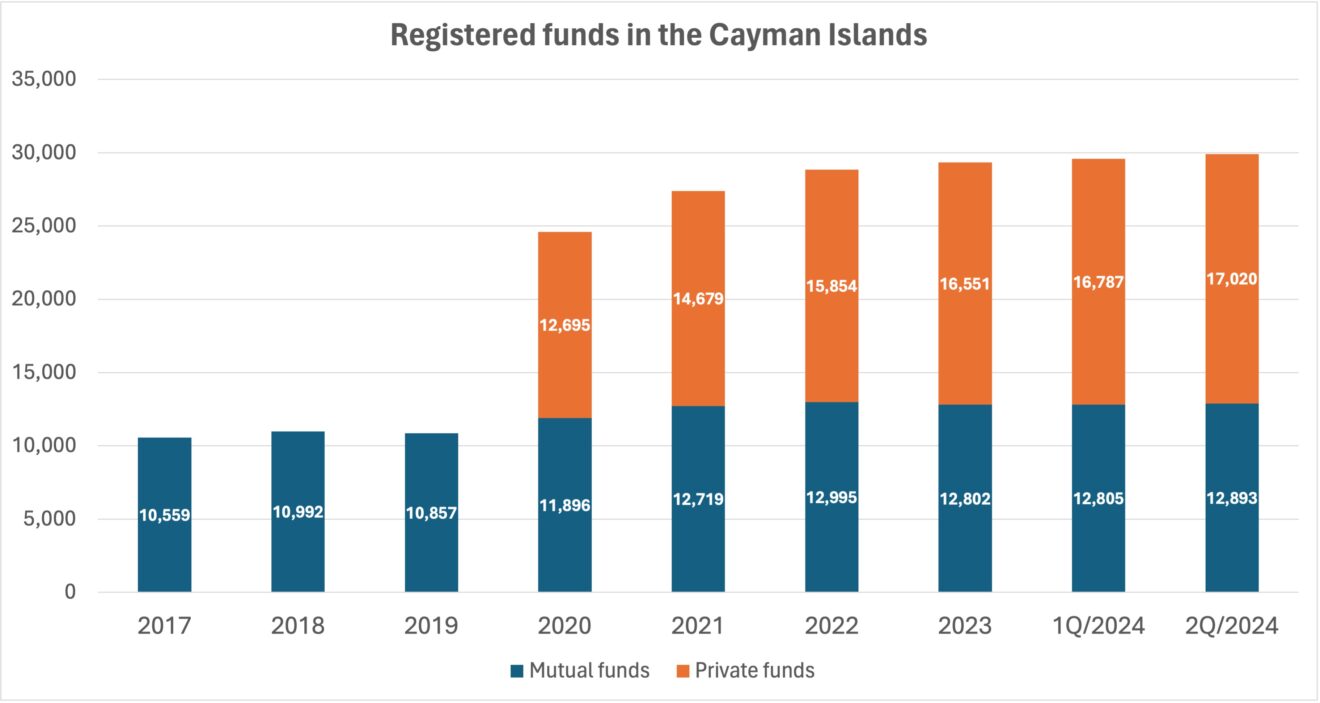

Fund formations picked up in the second quarter of 2024. The net number of mutual funds registered in the Cayman Islands increased by 88 (0.7%) to 12,893, while private funds registered a net growth of 233 active funds (1.4%) to 17,020.

This brought total number of funds registered with the Cayman Islands Monetary Authority to 29,913.

Hedge fund performance is mixed

In the first half of the year, hedge funds showed a mixed performance, as US large cap tech stocks extended gains to record highs but political and geopolitical risks were on the rise, and European and Asian central banks cut interest rates despite persistent inflation.

In this environment macro funds which led performance in the first four months of the year struggled to maintain gains in May and June, and the performance of global currency, commodity and bond markets remained volatile.

The dispersion of returns ranged from the top performers posting close to 15% in gains to under-performers declining 2.22%.

Tech-focused equity hedge funds led the performance, while large multi-strategy funds recorded double-digit gains and global fundamental long/short equities hedge funds posted gains of 7.55% in the first half of the year, according to Goldman Sachs prime brokerage.

Overall political and economic certainty may, for the remainder of the year, favour allocations to those hedge funds that have shown a robust strategy to adapt to current market challenges, which are widely expected to persist.

Private capital funds meanwhile are sitting on record amounts of undeployed ‘dry powder’. The Financial Times reported in May that hedge funds are lamenting a difficult fundraising environment as investors have their money locked up in private capital funds that are not distributing any returns.

Citing Preqin data the FT noted that private capital firms have taken more money from investors than they have distributed back to them in gains for six consecutive years, for a total gap of $1.56 trillion over that period.

The lower rate of distributions from private equity, private debt and venture funds is having a knock-on effect, the FT reported, leading some allocators to pause on new investments into illiquid funds and reduce new investments in more liquid hedge funds.

Analysts at Morgan Stanley estimate the industry’s dry powder has reached about $4.5 trillion, excluding leverage, which will need to be deployed soon.

Fund finance market resilient

Maples Group reported in its July 2024 FUNDed newsletter that the global fund finance market has shown resilience in difficult economic conditions and the market continues to grow, despite constraints on banks’ lending capacity and higher interest rates.

Maples noted a consistent deal flow and many structured finance solutions that address capacity constraints among lenders.

In particular the use of bankruptcy remote structures has emerged as one of the key trends with a marked increase over the past 12 months.

“The Cayman Islands has shown itself to be particularly well-suited to these transactions, able to draw on a wealth of experience and technology from other segments of the market, most notably securitisations and asset finance,” Maples said.