Why smart money is flowing into the insurance asset class: A guide for institutional investors

Institutional investors – including investment funds, family offices, and endowments – are continually seeking avenues to diversify portfolios, reduce risk and enhance returns. One often-overlooked asset class that can achieve these objectives is the insurance asset class, which includes traditional equity investment in insurance and reinsurance companies, insurance-linked securities (ILS), and parametric insurance. This article explores why this asset class deserves a place in institutional portfolios, backed by data, historical performance, and trends. This article is not a recommendation to invest in these securities but instead offers an opportunity to explore why institutional investors should consider this asset class.

Before I delve into why insurance sector, below are some ways to gain exposure to insurance returns which by no means are an exhaustive list:

1. Direct exposure to insurance companies via stock exchange or private investment

2. Direct exposure to reinsurance companies

3. Insurance linked securities such as catastrophe bonds, industry loss warrants etc.

4. Alternative capital in the insurance sector via side cars, collateralised re etc.

5. Parametric insurance products and derivatives

6. Investment funds focused on insurance or insurance products

7. Bespoke portfolios which can include longevity life assets, quota shares among others

Each of these investment types offers different characteristics that can be customised to various time horizons, return expectations of the investor and genres (such as life insurance, property and casualty) which come with their own risk profiles.

The case for exposure in insurance assets

1. Diversification and low correlation

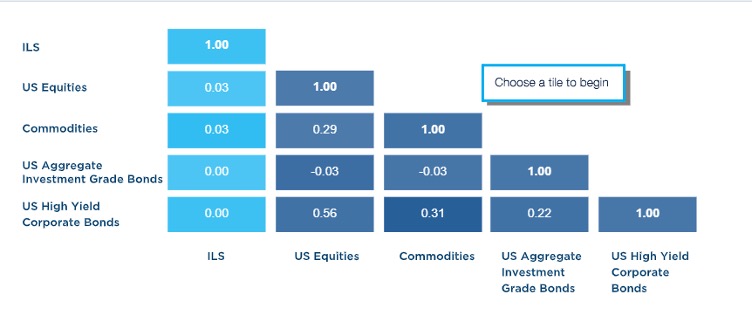

Insurance-related investments such as catastrophe bonds often exhibit low correlation with traditional asset classes like equities and bonds. This characteristic makes them excellent tools for diversification, potentially reducing overall portfolio volatility. Unlike stocks and bonds, which are influenced by economic cycles, insurance returns are driven by natural catastrophe events (e.g., hurricanes, earthquakes) and other non-financial risks.

Correlation Matrix of Asset Classes over a 10 year period ending 31-Dec-2024

Key statistic: The correlation between ILS and the S&P 500 is close to zero, providing a hedge against market volatility.

Industry insight: According to KKR’s Henry McVey, “family offices are increasingly allocating to insurance assets for diversification and uncorrelated returns. Their higher allocation to alternatives has helped them outperform pension funds and endowments.”

2. Attractive risk-adjusted returns

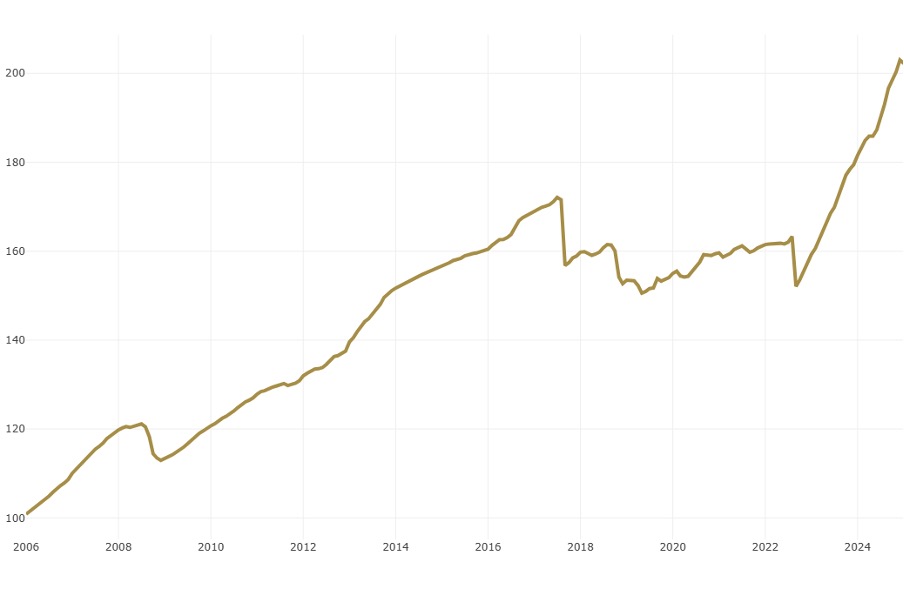

The insurance asset class has demonstrated competitive returns with relatively low volatility. For instance, the Eurekahedge ILS Advisers Index, which tracks the performance of Non-Life ILS funds, has shown consistent positive returns over the past decade.

Eurekahedge ILS Advisers Index Performance (2015-2024)

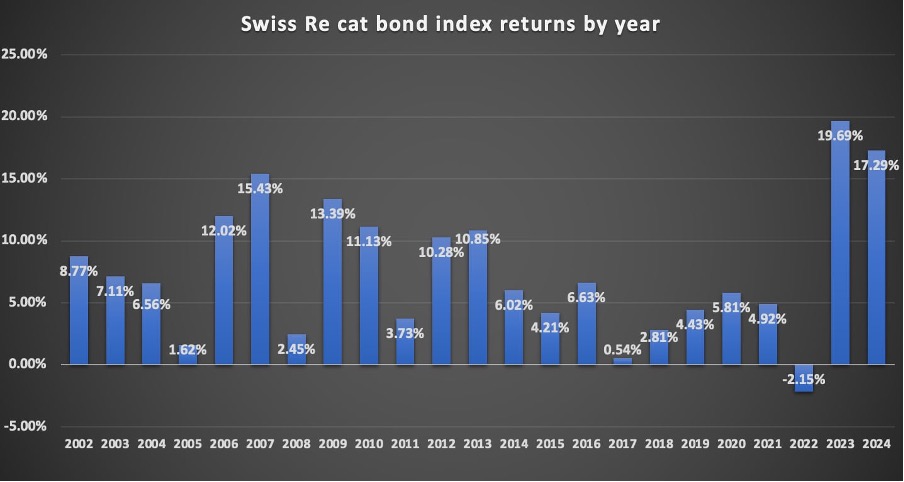

The Swiss Re Catastrophe Bond Index is the most widely used benchmark for the total-returns delivered by the current pool of outstanding cat bonds. At a 17.29% total-return for 2024, last year was the second highest annual performance on record for the Swiss Re Cat Bond Index.

Key statistic: The Swiss Re Global Cat Bond Index has delivered an annualised return of 7.2% over the past decade, outperforming many fixed-income alternatives.

ILS investments have shown resilience and consistent returns over time. This below table illustrates the cumulative returns of ILS compared to other asset classes, highlighting its low volatility and consistent performance even during major economic disruptions.

Historical returns of ILS vs. traditional assets

| Asset Class | 10-Year Annualized Return (%) |

| ILS (Cat Bonds) | 7.2% |

| S&P 500 | 13.1% |

| Corporate Bonds | 5.5% |

| Real Estate | 5.6% |

| Commodities | 8.3% |

Industry insight: According to Leadenhall Capital Partners, “Allocating capital to investments in insurance-linked securities (ILS) can offer investors a significant yield advantage as well as relative value, while ILS market risk premiums still offer one of the most attractive entry points ever.”

3. Capitalising on market growth

The global insurance and reinsurance market is expanding rapidly, driven by increasing awareness of climate risks, regulatory changes, and the need for innovative risk transfer solutions. According to the NAIC, the U.S. Property and Casualty industry reported total capital and surplus at June 2024 of $1.14 trillion growing from $703.6 billion in 2015 while the U.S. Life and A&H Industry reported total Capital and surplus at $507 billion growing from $367.0 billion in 2015. This growth underscores the stability and potential returns of the insurance asset class.

The ILS market has experienced significant growth, with the total market size reaching approximately $113 billion in 2024 from $20 million in 2015. This expansion indicates a robust and maturing market, offering ample opportunities for investors.

4. Tax-advantaged growth

Insurance assets, especially permanent life insurance policies, offer significant tax advantages. The cash value within these policies grows on a tax-deferred basis, similar to retirement accounts like 401(k)s or IRAs. Additionally, death benefits are typically tax-free to beneficiaries, providing an efficient way to transfer wealth.

For high-net-worth individuals and family offices, the tax-advantaged nature of insurance assets can be a significant advantage. Compared to other investments subject to capital gains, dividends, or income taxes, permanent life insurance offers a tax-efficient way to grow wealth and ensure a tax-free transfer of assets to heirs.

5. Stable cash accumulation

Permanent life insurance policies, such as whole life and universal life, are designed to build cash value over time. While the growth is generally more conservative compared to equities, the stability and predictability of these policies can be attractive for risk-averse investors.

Unlike stocks or real estate, the cash value of a life insurance policy is not subject to market volatility. Whole life insurance policies typically offer guaranteed returns and dividend payments, which can further enhance the cash value over time.

Insurers themselves can benefit from ILS investments by diversifying their risk profile and accessing uncorrelated asset income streams.

6. Inflation hedge

Insurance-linked assets, particularly parametric insurance, are often structured to pay out based on predefined triggers (e.g., wind speed, earthquake magnitude) rather than actual losses. This structure makes them less susceptible to inflation-driven claims inflation, providing a natural hedge against rising prices.

Key statistic: Parametric insurance payouts are typically uncorrelated with inflation, unlike traditional insurance claims, which can rise with inflation.

Industry insight: Research by Neuberger Berman shows that adding ILS, particularly Industry Loss Warranties (ILWs), to institutional portfolios can lead to:

- Improved balance sheet efficiency

- Reduced exposure to credit cycles and sovereign spreads

- Enhanced risk-adjusted returns

7. Social and environmental impact

Investing in the insurance asset class also has some altruistic impact and is key to support the wider communities around the globe to be insured. Investments in insurance sector not only allows investors to get exposure to insurance returns, but it allows insurance companies to continue to provide access to insurance which would not otherwise be possible due to capital requirements.

For example, Kshema Insurance has been a game-changer for farmers in India, particularly for small and marginal farmers who are most vulnerable to the uncertainties of agriculture. By providing crop insurance, Kshema Insurance offers a financial safety net that helps farmers recover from losses due to unpredictable weather, pest infestations, and market fluctuations. This insurance not only ensures financial stability but also encourages farmers to adopt modern and sustainable farming practices without the fear of financial ruin. As a result, Kshema Insurance has played a crucial role in empowering farmers, reducing their dependency on high-interest loans, and promoting long-term agricultural sustainability.

Similarly, investing in the insurance asset class also allows institutional investors to support resilience in communities affected by natural disasters. For example, parametric insurance can provide rapid payouts to disaster-stricken areas, enabling faster recovery. After Hurricane Maria in 2017, parametric insurance policies paid out $150 million to the Caribbean within 14 days, compared to traditional insurance claims that took months to settle.

The insurance asset class offers institutional investors a unique combination of diversification, attractive returns, and social impact. By allocating a portion of their portfolios to insurance, reinsurance, ILS, and parametric solutions, investment funds, family offices, and endowments can enhance their risk-adjusted returns while contributing to global resilience. As the market continues to grow, now is the time to explore this compelling opportunity.

While the insurance asset class offers compelling benefits, it is not without risks. It is important to understand the risks and consider the required mitigation to these risks. Institutional investors should consult with insurance asset class experts and consider pilot allocations to this innovative asset class. With the right strategy, the insurance asset class can become a cornerstone of a well-diversified, high-performing portfolio.

Rudy D’Cunha is Global Head of Insurance Services at Apex Group and Managing Director, Apex Insurance Services (Cayman) Ltd.