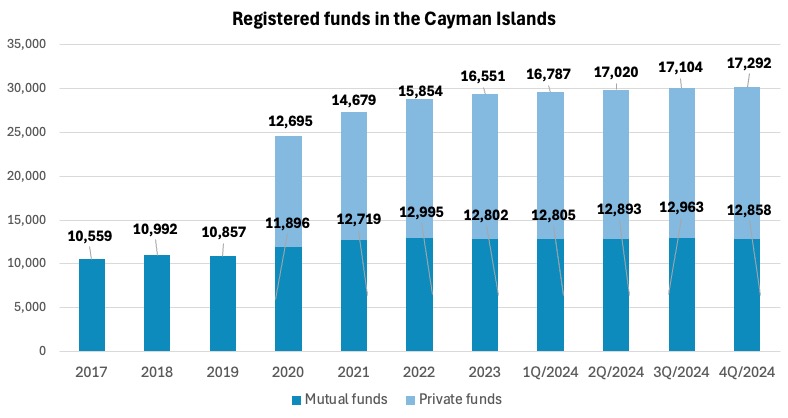

Cayman remains the preferred domicile for hedge funds and private funds as the number of funds registered with the Cayman Islands Monetary Authority climbed by 2.7% to a total of 30,150 in 2024, full-year data from the financial regulator shows.

While the number of open-ended so-called mutual funds grew marginally, up 53 funds (0.4%) compared to 2023, closed-ended private funds numbers continued to rise by 741, or 4.8%.

Even a drop by more than 100 mutual funds in the fourth quarter of 2024 did not halt the growth, as the industry added almost 200 private funds during the final quarter of the year.

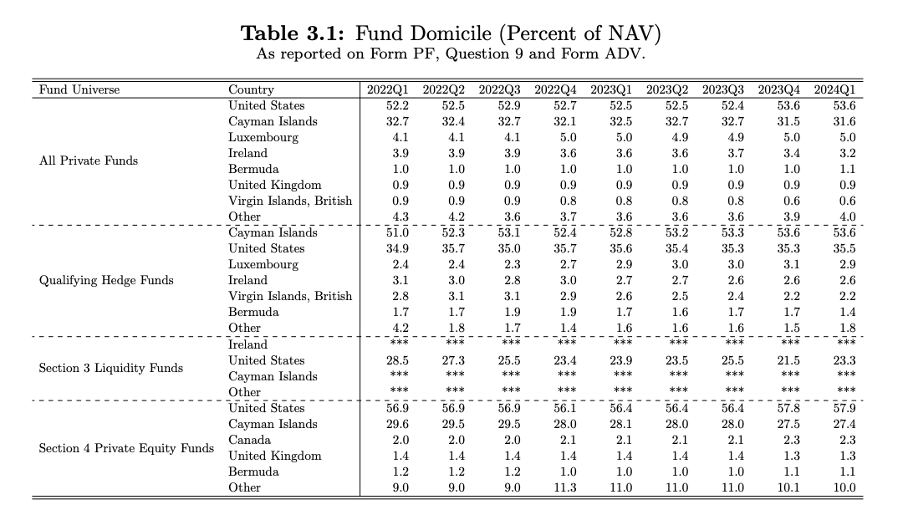

Most Cayman private funds are managed from the United States and registered with the US Securities and Exchange Commission (SEC). The latest available SEC data for the first quarter of 2024 shows that 31.6% of the net assets of all private funds under the purview of the US securities regulator are managed by funds domiciled in the Cayman Islands, followed by 5% in Luxembourg and 3.2% in Ireland.

When it comes to hedge funds, 53.6% of all qualifying hedge fund net assets reported to the SEC are managed by Cayman-domiciled funds.

During 2024, hedge fund equity strategies recovered, while credit strategies remained strong.

Law firm Walkers observed that nearly 40% of hedge funds launched by its clients last year pursued an equity strategy but noted that credit stayed strong, too, most likely because borrowers struggled to raise debt from traditional sources amidst higher-than-average interest rates.

“Credit funds have long had a role in assembling credit solutions for unconventional or higher risk borrowers, and this has continued this year as our clients seek opportunities in these markets,” the law firm said in its 2024 Fundamentals white paper.

Multi-strategy funds, in turn, saw several years of significant allocations, and while some market commentators suggested investor enthusiasm had slowed in recent months, Walkers said it has not noted a slowdown of new fund launches among its clients.

Most industry trackers reported an increase in overall hedge fund assets under management in 2024. However, this was mostly the result of profits rather than significant investor inflows, as most sectors have seen net outflows.

“In part, this may be down to hedge funds’ position within the broader alternative asset landscape, where in recent years there has been little in the way of liquidity and realisations by private equity and venture capital firms, and thus hedge funds have served as a comparative source of liquidity for institutional investors that allocate across a broad range of alternative investments,” Walkers said in its white paper.

Among private funds the law firm found a marked resurgence of buyouts and real estate investments. Debt and private credit also remained very active but the their share of all private fund launches decreased slightly.

“In terms of the geographical focus of investment activity, North America and Asia remain the primary focal points for private fund investments, with allocations staying largely consistent with previous years despite the fluidity of other market conditions,” the law firm added.