This article forms part of a series of articles examining the opportunities Japan presents for investment managers and investors. It focuses on private equity funds1 and the Cayman Islands exempted limited partnership.

Japan’s flourishing private equity market

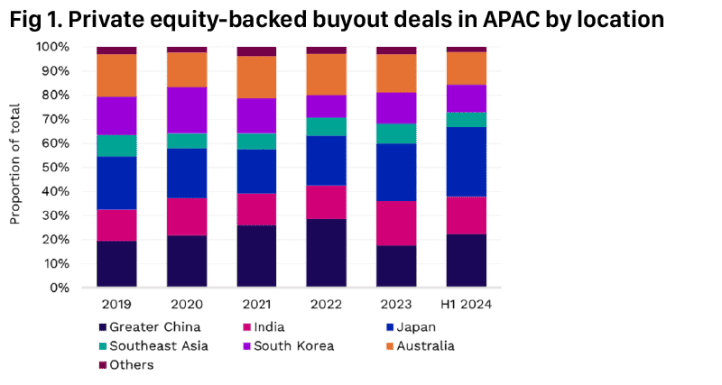

Japan has been the largest and most active private equity (PE) market in APAC since 20232 (Fig 1). PE related dealmaking in Japan jumped last year as ample supply of targets, low interest rates, a weaker Japanese Yen and improved corporate governance helped Japan buck the trend to make the country the only market in APAC to see growth in 20233 and dealmakers anticipate a busy pipeline ahead.4

There is a growing number of investors chasing deals in Japan. The number of General Partners (“GP”) with a Japan office and a latest buyout/turnaround fund that is more than or equal to JPY 50 billion have doubled between 2012 and 2024, with more domestic GPs growing to this size. There is also a large group of foreign investors not yet ‘on the ground’ in Japan that is showing clear interest to be more active.5 Additionally, PE is also a preferred strategy of large Japanese Limited Partners (“LP”).6

Fundraising for buyouts in Japan defied the global trend of peaking in 2021 and then declining since. Instead, Japan buyout funds raised US$4.6b in 2023, three times the 2022 total7. The fundraising streak has continued in 2024 with Japan leading the way for Asia ex-RMB-denominated funds in the second quarter of 2024.8

The advantages of the Cayman Islands

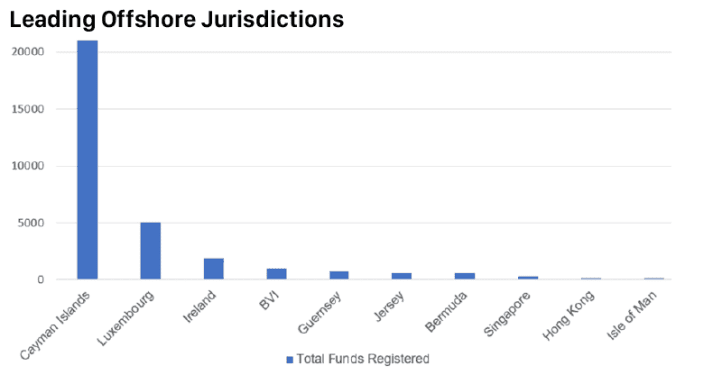

When fundraising, it is important to use a reputable, well-established investment funds jurisdiction that LPs are familiar with. The Cayman Islands is the leading jurisdiction for offshore investment funds, attracting about 80% of all new offshore fund formations globally.

The Cayman Islands is at the forefront of the investment funds industry because of the numerous advantages it offers including:

- Investor familiarity – a vital consideration when fundraising.

- Tax neutrality.

- Expertise in the investment funds space and experienced professional service providers.

- Economic and political stability.

- Commercial and flexible legislation.

- Well established, respected and sophisticated legal system.

- No exchange controls restrictions.

- The Cayman Islands is on the OECD “white list”.

Japan’s investment flows through the Cayman Islands

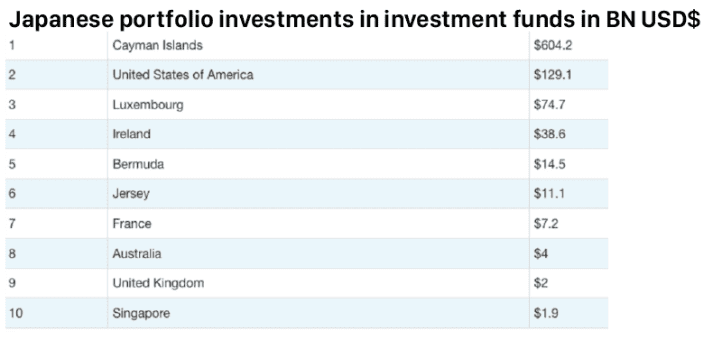

The Cayman Islands is also the jurisdiction of choice favoured by Japanese GPs and LPs for investments in overseas investment funds. The Cayman Islands currently attracts more than two thirds (67.3%) of Japanese investments in overseas investment funds.9 At the end of 2022, Japanese holdings in Cayman Islands investment funds amounted to JPY 87.6 trillion.

The use of exempted limited partnerships for PE funds

The Cayman Islands offer a range of vehicles that could be used to structure an investment fund including the exempted limited partnership (ELP), the unit trust10, the exempted company, the limited liability company and the segregated portfolio company. The choice of structure is largely driven by the needs of the particular investment fund and its investors.

The ELP is widely used globally to structure PE funds including funds that have been established for in-bound investments into Japan and outbound investments. The ELP structure is commonly used to admit both Japanese LPs and global LPs. Depending on the size and requirements of the PE fund and the composition of LPs, more than one ELP may be formed to act as parallel funds or feeder funds (e.g. it is not uncommon to form an ELP solely for Japanese investors and another ELP solely for non-Japanese investors) and further ELPs may also be formed to act as co-investment vehicles for certain LPs.11

The ELP is ideally suited for use in a PE fund context where contractual flexibility and tax transparency are often key considerations.

The ELP is a contractual arrangement between the GP who conducts the business of the ELP and the passive investor LPs. The development of the Cayman Islands laws governing the ELP have been guided by the demands of the PE industry and are generally permissive and allow for contractual freedom. The contractual nature of the ELP provides sufficient flexibility to accommodate all the typical provisions commonly negotiated between GPs and LPs such as, the provision of side letter arrangements to select LPs, and all the key terms of PE funds including capital commitment and capital call arrangements, excuse provisions and default provisions, investor allocations and distributions, carried interest waterfalls, catch up provisions and other fee arrangements, LP advisory committee provisions and key man terms, amongst others.

An ELP is not an entity distinct from its partners and has no separate legal personality of its own. Having no legal personality of its own, the ELP is generally regarded as being tax transparent (or as having tax ‘flow-through’ status) for domestic tax purposes, including in Japan.

LPs of an ELP enjoy the protection of limited liability and are not liable for the debts and obligations of their ELP as long as they do not take part in the conduct of the business of the ELP with persons who are not partners of the ELP.

The GP of an ELP is typically established as a special purpose vehicle (SPV) which has the advantage of insulating the investment manager from the GP’s liability for the ELP’s debts and obligations in the event the assets of the ELP are insufficient. The GP SPV is typically established and controlled by the investment manager, thereby permitting the investment manager to manage the PE fund without the need to involve a third-party operator. The GP SPV is often established as a Cayman Islands exempted company but may also be a foreign company e.g. a Japanese company.

1The term ‘private equity’ is used in this article to refer to a range of non-retail, typically closed-ended funds including buyout funds*, real estate funds, venture capital funds, infrastructure funds, private credit/debt funds, activist funds and fund of funds. *Maples Group Advises JIP on the JIP-led Consortium for The Largest Take-Private Deal in Japan’s History

2Bain & Company’s Japan Private Equity Report 2024.

3Bloomberg article “Japan Private Equity Deals Jump in Otherwise Gloomy Year for Asia” dated 25 March 2024.

4Mergermarket Japan Forum Explorer article “Dealmakers anticipate busy pipeline ahead despite slow start in 2024” dated 24 June 2024.

5Bain & Company’s Japan Private Equity Report 2024.

6Preqin First Close newsletter dated 28 May 2024.

7Preqin First Close newsletter dated 28 May 2024.

8Mergermarket article “Asia private equity 2Q analysis: Japan, India underscore their popularity” dated 16 July 2024.

9‘Japan’s investment flows through the Cayman Islands’ by Cayman Finance dated 14 July 2023.

10Exploring Japan’s Evolving Investment Landscape: Opportunities for Asset Managers

11If there is a sufficient number of EU investors, an EU based (e.g. Luxembourg or Ireland) parallel or feeder fund may also be formed solely for EU investors. Our next article in the series will explore the fund structuring options available in Luxembourg and Ireland.

Sharon Yap is a partner of Maples and Calder’s Funds & Investment Management team in the Maples Group’s Hong Kong office.