Cryptocurrencies, blockchain and decentralisation were once the domain of anti-establishment retail traders, but the market has matured into one of the most exciting and innovative financial developments in decades.

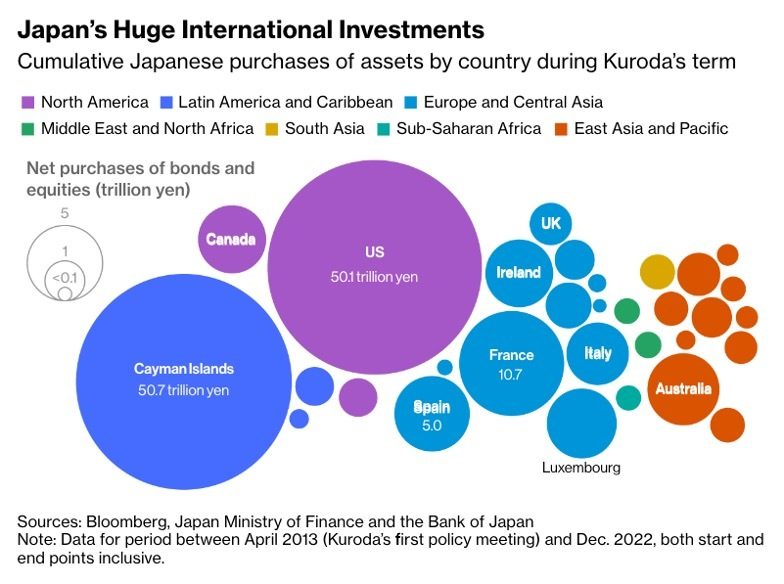

2024 marks 10 years since decentralisation was first developed. Since then, the global tech sector has jumped at the chance to introduce new products like decentralised autonomous organisations (DAOs) and tokenisation, while investment hubs, such as Bermuda, the British Virgin Islands (BVI), Cayman Islands and Channel Islands, have become major jurisdictions for the digital assets industry.

Evolving regulation and developing legal frameworks have undoubtedly influenced how decentralisation works, but there’s still plenty of scope for improvement. Drawing on insights from our seasoned experts, we’re exploring the decentralisation developments of the past decade and forecasting the trends that will shape the next 10 years in the sector.

Decentralisation and regulation: Square peg, round hole

The early years of blockchain saw regulations largely absent or ill-suited to the unique challenges of digital assets, often trying to fit the modern technology into traditional securities frameworks.

The inherent benefits of blockchain, such as immutability and transparency, were not well understood. Instead, the outsized focus on blockchain’s anonymity led many regulators to conclude that it was only useful for financial crime.

This has resulted in major jurisdictions like the US and China taking stringent stances, often viewing cryptocurrencies through a lens of suspicion. High profile clashes between the SEC and the crypto industry have taken centre stage in the media time and again.

However, some countries have risen to the challenge and have emerged as digital asset and innovation hubs.

How have investment hubs and international financial centres approached digital assets regulation?

Instead of taking a hardline approach, investment hubs have adapted legislation to better fit the digital asset mould. In the last five years, Bermuda, the Cayman Islands and BVI have all introduced dedicated virtual assets regulatory legislation; Singapore and Hong Kong soon followed suit.

Not only have these jurisdictions legislated around decentralisation rather than fighting against it, but the laws have also been regularly reviewed and updated to ensure they work properly.

For example, after Bermuda’s 2018 Digital Assets Business Act was introduced, it was swiftly updated and enhanced in 2020 along with changes to Bermuda’s Insurance Act to consider new technological developments across the digital assets business and (re)insurance innovations sector.

Another instance is in the Cayman Islands, where digital assets legislation was introduced in 2020 and amendments to introduce licences for crypto custodians and trading platforms are being consulted on this year.

There’s still work to be done

The battle over whether some digital assets are defined as securities has been a headline in the media for some years now, but another issue is that different countries taking different approaches to otherwise global assets creates friction. On the one hand, legislation like the EU’s MiCA Act brings us closer to global alignment in digital assets regulation; on the other, there’s still a long way to go before we’re all on the same page.

While the current opportunity for jurisdictions with developed digital assets legislation is drawing in the digital assets sector, the end journey for crypto businesses is more complicated. They must navigate several different sets of regulations depending on how global their business is.

We foresee more work will be done across jurisdictions to better coordinate on regulations and laws. The ideal scenario is a global set of regulations to better suit this purely digital sector.

The impact of regulation and innovation

There have undoubtedly been clashes between the digital assets industry and global regulators, but that doesn’t mean all regulatory developments have been challenging to enforce. In fact, some have even sped up industry innovation.

Digital sandboxes create a safe space for crypto

Regulatory frameworks can significantly affect the pace and direction of positive change in the blockchain industry. ‘Digital sandboxes’, live testing environments for digital assets businesses to pass regulatory compliance and security checks as they grow, have been crucial for the sector to innovate while staying on the right side of the law.

The UK was the first to introduce the concept for blockchain, with the US and EU following suit. If the relevant regulatory body thinks the product is safe, then an expedited path to regulatory approval can be available. The Cayman Islands, Bermuda and the BVI all have digital sandboxes in place as well for offshore-based digital assets companies to safely innovate.

Investment hubs allow for flexibility

Crypto businesses are after the best locations to set up their companies. Since 2012, the Cayman Islands has had special economic zones to attract tech and crypto companies; Singapore and Dubai offer comparable benefits.

There’s also been regulatory arbitrage, where businesses choose jurisdictions based on the most favourable regulatory environments, in the decentralised sector. As a result, we’ve seen specific structures evolving to accommodate and compete for business.

For example, the BVI is a hub for blockchain activities due to its flexibility in token issuances. This has encouraged digital asset businesses to set up shop in the jurisdiction for their operations. The Cayman Islands is another option, having become a go-to destination over the years for DAO governance structures and regulated digital assets service providers.

Bermuda is well-established as a jurisdiction where global digital assets exchanges, digital assets derivatives exchanges and stablecoin issuers can set up and be supervised under a clear legislative framework that is risk-based rather than rules-based.

Litigation is on the way

Blockchain is still a fledgling part of the digital assets and wider financial industry, but litigation is popping up in the space and highlighting how difficult it is to apply old legal paradigms to new tech. Some examples are Three Arrows Capital’s liquidation proceedings and, of course, the infamous FTX collapse in 2022.

The key challenge for regulators over the next decade is to come up with systems that work with the decentralised nature of blockchain and digital assets, while focusing on consumer protection and accountability at the same time. It’s a delicate balancing act, with potentially some new legal frameworks needed, to embrace blockchain.

Some of the corporate failures have led to the courts in these investment hubs developing jurisprudence around the treatment of digital assets, including the Bermuda courts which have overseen insolvent restructurings and liquidations in the sector.

Decentralisation regulatory predictions

Looking ahead, the consensus among legal experts is that regulations will continue to evolve to better accommodate the peculiarities of digital assets while protecting investors.

Legal frameworks won’t stay still

The approach to digital assets is constantly moving forward. For example, the Cayman Islands is currently consulting on amendments to the digital assets legislation introduced a few years ago, and Bermuda has already made changes to its 2018 Act and will continue to iterate. The Bermuda Monetary Authority has recently produced consultative guidance on single currency pegged stablecoins.

This trend of ongoing legislative refinement suggests a shift towards more bespoke regulatory environments that can better accommodate blockchain technology’s quirks. In the short term, the aim of the game is to protect consumers, while also balancing long-term institutional investor growth into the sector.

AML challenges persist

Crypto has an image problem, and regulation will help fix it. A key focus in the coming years will be on anti-money laundering (AML) and counter-financing of terrorism (CFT), particularly as unregulated virtual assets businesses are rife.

The challenge is complicated by the fact that many users access crypto platforms through VPNs, muddying the waters of enforcement and oversight. Digital asset hubs may seek to boost their regulatory frameworks with stricter guidance and enforcement measures.

On top of this, international standards, such as those from the Organisation for Economic Co-operation and Development (OECD), are likely to add pressure on jurisdictions to strengthen their regimes around reporting digital assets so they can tackle tax evasion.

As technological solutions for collection and identity verification evolve, regulators are becoming increasingly aware of developments in the regtech space. We expect this will lead to modernising many of the regulatory frameworks – and belated recognition of decentralised ledger solutions’ benefits, such as transparency and auditability.

A streamlined approach

The global nature of the blockchain industry, which inherently lacks borders, poses a headache for regulators. There’s an optimistic outlook that regulators will streamline their approaches over the next decade, but some are more pessimistic.

The ideal scenario would be introducing more coherent and comprehensive regulations for blockchain. There’s a need to address the unique challenges of overseeing a decentralised and international market, while balancing consumer protections.

Increased international cooperation is a must for making effective regulatory frameworks that can properly handle the borderless operations of blockchain enterprises. The question is: can this be a plausible reality in the next decade, or is it blue-sky thinking?

Changes in legal approaches to investment and dealmaking

The approach to dealmaking and investment in blockchain ventures is now unrecognisable from just 10 years ago. As digital assets businesses grow and consolidate, onshore law firms and their offshore counterparts must now work together to align investment structures with local laws and regulations.

Here are some other ways the dealmaking scene in the blockchain industry could develop.

Multi-jurisdictional structures

In recent years, the structures used for setting up blockchain ventures have become more intricate and refined. As with any new industry, the initial approaches were ad hoc and unprecedented. Today, they involve sophisticated, multi-jurisdictional setups, often involving entities in Bermuda, BVI and Cayman Islands.

US law firms frequently initiate these structures from an onshore perspective; legal counsel in the Cayman Islands, Bermuda and the BVI will then advise on local laws to ensure the deal goes ahead in the optimum manner in compliance with local laws.

This evolution marks a move towards more established, legally sound frameworks for digital assets entities in jurisdictions that cater to the complexities of global fintech operations. We expect this to only grow as the market matures.

The hard-line influence on blockchain deals

The regulatory approach in the US and China can’t be ignored in the digital assets industry. It’s therefore no surprise that the strict enforcement approach from major economies has significantly influenced how blockchain products are structured and marketed.

Perceived uncertainty with US regulations has led to some global digital asset exchanges and counterparties avoiding dealing with US-held digital assets businesses altogether, reflecting the scrutiny these deals attract. This environment has forced a cautious approach to legal structuring, particularly as the SEC in the US intensifies its regulation by enforcement approach.

It’s more important than ever for regulatory lawyers to stay up to date in this fast-moving area of law. For clients looking to operate in the US, top tier legal advice and strategic planning is always a must.

Growing institutional interest

Gone are the days of blockchain relying on seed rounds and convertible notes. Now, the sector is bringing in substantial capital injections from major venture capital (VC) firms and institutional investors. This is only set to grow in the coming 10 years as digital assets are marketed through institutional finance vehicles such as exchange traded funds (ETFs).

With this shift, legal considerations like proof of reserves, bankruptcy remoteness and the segregation of assets and liabilities have become the biggest challenge for the legal industry to overcome. These measures, combined with effective regulation, are crucial for mitigating the high-profile risks associated with market contagions and another FTX-style collapse.

The rise of tokenisation

Tokenisation of real-world assets, or when rights to a real-world asset are recorded on the blockchain, is the latest buzzword in the digital assets industry.

This will not only shape the regulatory landscape with adapting to how assets are moved and tracked with tokenisation, but the dealmaking sector could see a big shift in how decentralised finance changes asset ownership and management.

The intended long-term impact of tokenisation is that trading assets will become much easier. If the proper checks and balances are in place, we expect this type of blockchain deal will continue to take off into the next decade of decentralisation.

The future of international regulatory frameworks

There’s a growing call for international regulatory frameworks to evolve in tandem with blockchain advancements. This evolution is crucial for harmonising regulations across different jurisdictions.

International groups like the Financial Action Task Force (FATF) and the OECD are expected to play pivotal roles in setting global standards, which could lead to more uniformity in how digital assets are regulated worldwide.

Increased international communication

Blockchain assets are without borders, but current regulations are fragmented. Major regulatory jurisdictions like the UK, EU and US all have completely different approaches; even more flexible jurisdictions like the Cayman Islands, BVI and Bermuda are only somewhat aligned.

International bodies like the OECD and FATF have global guidelines, but these aren’t enforceable and are up to different countries to interpret. We’re looking for more conversation between international regulators to create a more unified global regulatory landscape. Making things simpler for clients and the legal sector alike should be a top priority.

These efforts are likely to be spearheaded by prominent international bodies like the FATF and OECD, as they have done for the last decade. Investment hubs with already proven frameworks will then examine their regulations with the official guidance in mind.

While some countries like the US and China may resist certain platforms, digital assets aren’t going anywhere anytime soon. The only practical path forward is through cooperative regulatory efforts.

Healthy competition between offshore countries

As the regulatory landscape for digital assets develops, investment hubs will be looking to draw in new business from crypto companies setting up offices. The same goes for Singapore and Dubai, especially when special economic zones and digital sandboxes are already key features of the local economies.

Healthy competition between jurisdictions like BVI, Bermuda and the Cayman Islands could promote a more balanced playing field, ultimately leading to better-standardised global regulations. We could even see these investment hubs leading the way forward for regulation in digital assets.

Tech and modern compliance

If digital assets are cutting-edge tech in the decentralised finance world, then innovative technologies in compliance should join the party to make blockchain safer and more transparent.

Advancements like biometric verification and digital IDs could completely change the face of digital assets regulatory practices by giving more reliable and universally acceptable compliance methods. This shift could help create a more seamless global regulatory framework, reducing the complexity and cost of compliance for international businesses.

It’s hard to imagine a mature regulatory framework for decentralised finance without these big leaps forward in compliance. We hope to see further developments in this area over the next decade to make blockchain accessible for all.

Conclusion

The past decade has been a wild ride for decentralisation, but it’s also set the foundations for a strong regulatory environment. Regulators and crypto companies have started working together to understand how this recent technology can be compliant globally.

As we look ahead to the next 10 years, the drive towards regulatory harmonisation and the continued evolution of global legal frameworks is crucial for decentralised finance’s future. With exciting developments like tokenisation picking up institutional investor interest, it’s time for digital assets to go mainstream.

Lucy Frew is a partner at Walkers and heads up the firm’s Global Regulatory & Risk Advisory Group.

Natalie Neto is a partner at Walkers based in Bermuda.