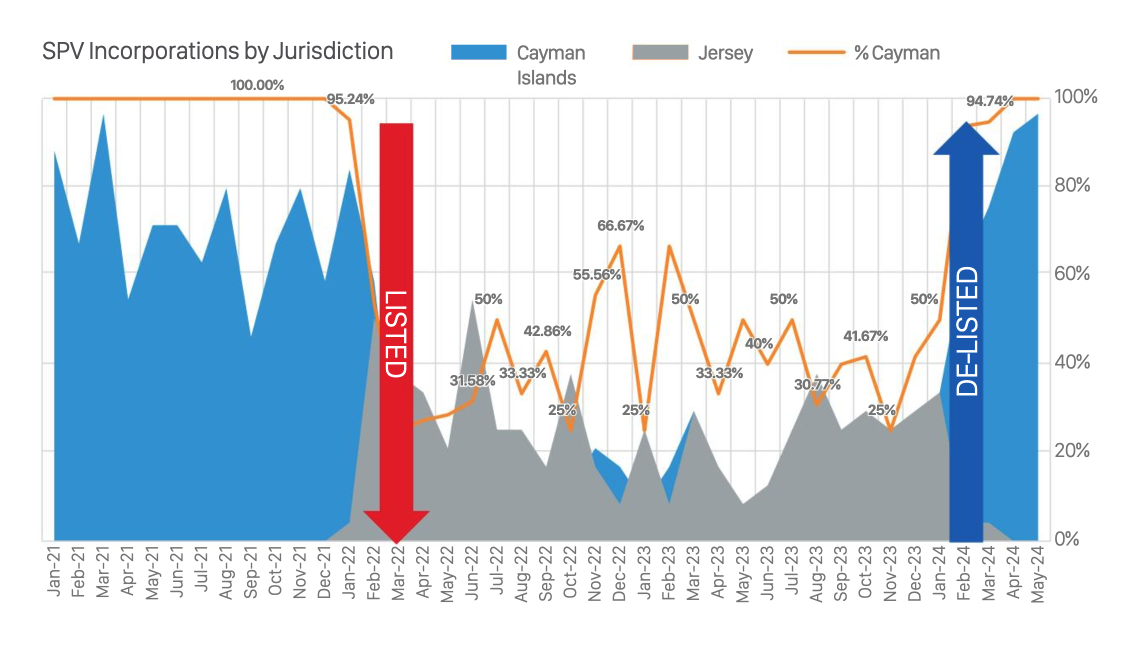

Maples Group has noted a move back to Cayman Islands special purpose vehicles (SPVs) for US warehouses and collateralised loan obligations (CLOs) since Cayman has been removed from the Financial Action Task Force (FATF) anti-money laundering list on 7 February 2024.

A collateralised loan obligation (CLO) is a security backed by a pool of debt, consisting often of corporate loans with low credit ratings or loans taken out by private equity firms for leveraged buyouts. These securities are divided into different tranches with varying levels of risk and return for investors. Warehouses are used by CLO managers to accumulate loans before they issue a CLO.

Prior to the grey-listing, the Cayman Islands was the leading jurisdiction for CLO structures for US issuers. This changed when the islands were included on the FATF’s so-called grey list for countries whose anti-money laundering regimes are under increased monitoring.

Under European Union law, countries listed by the FATF are automatically placed on the EU list of high-risk third countries for money laundering.

The EU Securitisation Regulation, in turn, bans the use of special purpose vehicles (SPVs) in EU AML-listed countries. This, for instance, prohibited EU investors from investing in US collateralised loan obligations which use Cayman Islands SPVs.

As a result, Jersey emerged since 2022 as the preferred alternative for securitisation and other securities issuance transactions with EU investors.

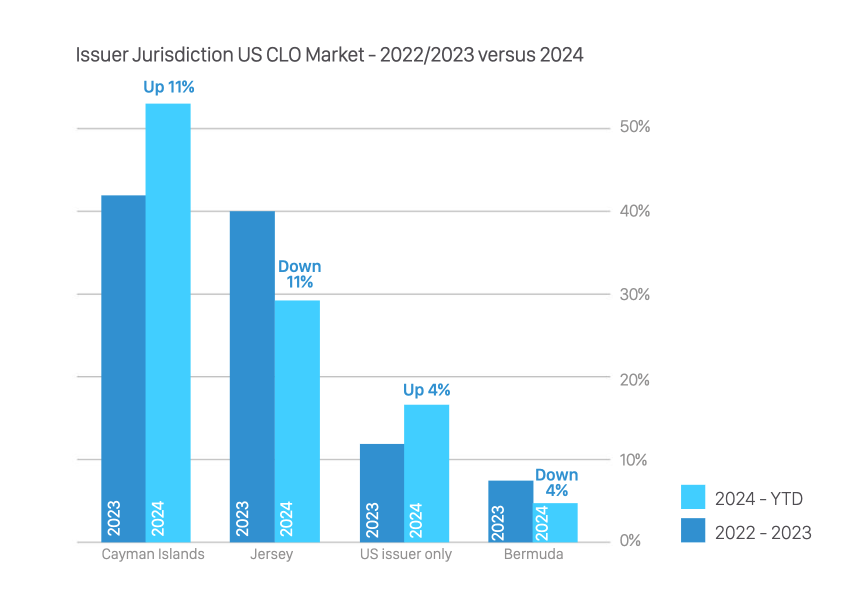

In its June 2024 CLOser industry newsletter for the global CLO market Maples said it continues to see a legacy of Jersey SPVs and some deals closing with a Jersey issuer but that number is decreasing and CLOs are migrated back to Cayman.

This year to date more US CLO deals closed in Cayman, up 11 percentage points with a 53% market share, and fewer in Jersey, down 11 percentage points to a market share of 29%, compared to the same period in 2023.

Maples said it expects the jurisdictional split will begin to “shift considerably” in the coming months, “as the market largely returns to the pre-EU AML listing position, in which the Cayman Islands was the traditional jurisdiction of choice.”