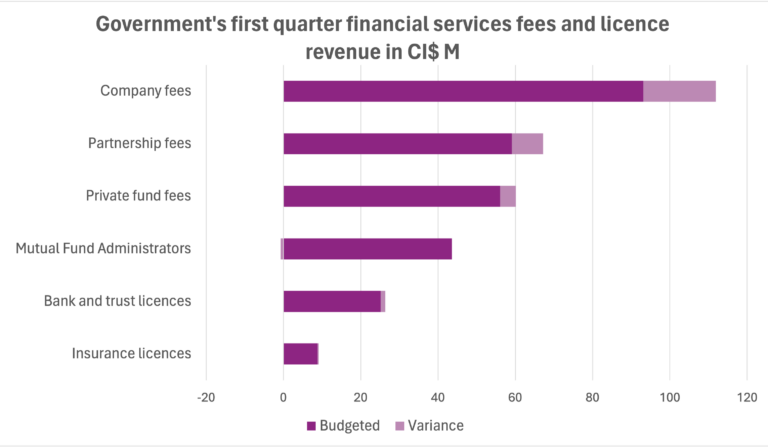

Licensing fees from companies, partnerships, banks and other entities have pushed government revenues higher than budgeted in the first quarter of 2024.

Duty, fee and licensing revenue during the period was $27.4 million higher than expected and $33.6 million higher than in the first quarter of 2023, government’s unaudited financial results show.

Fees from company, partnership and private fund registrations together with bank, trust and insurance licence fees brought in $31.74 million more than projected by the budget.

Exempt company fee revenue alone was $15.5 million higher than expected, mainly as a result of fee increases implemented in 2023. Partnership fees brought in $8.1 million more and private fund fees added $4.1 million more than anticipated.

The better-than-expected performance of the financial services sector covered various public healthcare expenses and transfer payments for scholarships and bursaries, as well as financial assistance that all came in over budget.

Meanwhile, government’s personnel costs increased by $6.1 million in the first quarter but remained below the budgeted amount due to unfilled positions.

Compared to the first quarter in 2023, core government revenues have increased by $39 million to $512.4 million and total expenses have risen by $22.2 million to $260.6 million.

The unaudited financial results of the core government for the first quarter show a $251.8 million surplus and a $260.2 million surplus for the entire public sector, which includes statutory authorities and government companies (SAGCs).

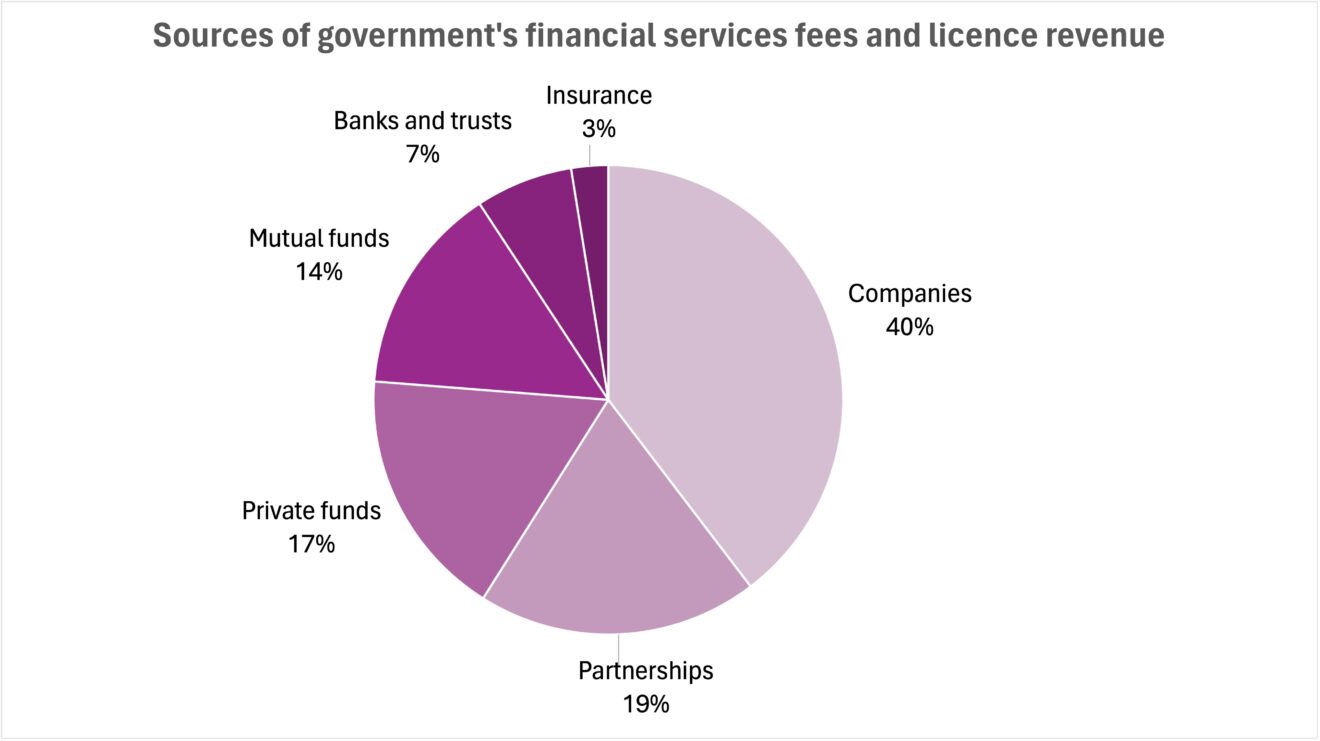

Most financial services fees, which make up more than one third of government’s annual revenue, are due in the first quarter. Budget surpluses achieved during the period diminish throughout the rest of the year when government expenses exceed revenues.