Michael Klein

Entity registration activity in the Cayman Islands in 2023 has been robust in a challenging macroeconomic environment amid rising interest rates. Private funds, partnerships, foundation companies and segregated portfolio companies continued to see rising demand, albeit at a somewhat slower pace than in previous years. In the insurance sector, the Cayman Islands Monetary Authority (CIMA) licensed the largest number of new international insurers in a decade, driven in part by Cayman’s growing attractiveness as a reinsurance domicile.

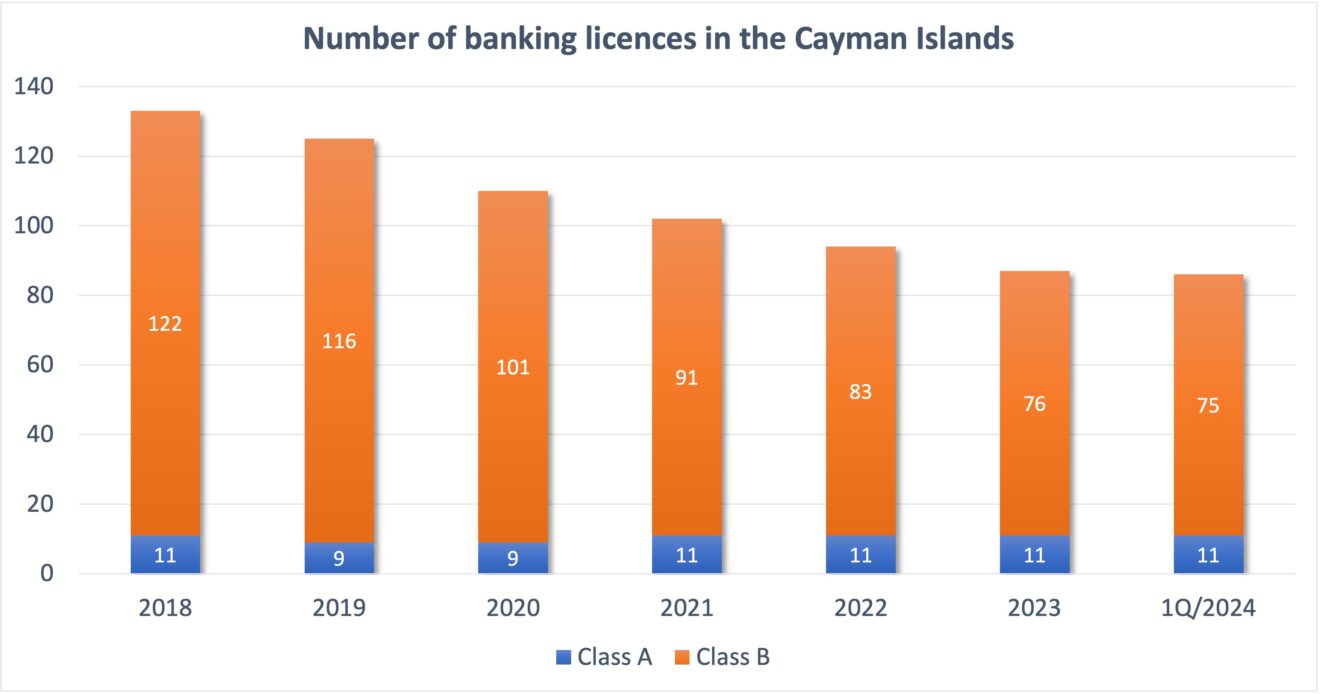

The rise in fund formations and the continuous drop in banking licences reflects Cayman’s long-time standing as the second largest fund domicile in the world, after the United States, rather than its historic designation as an offshore banking centre.

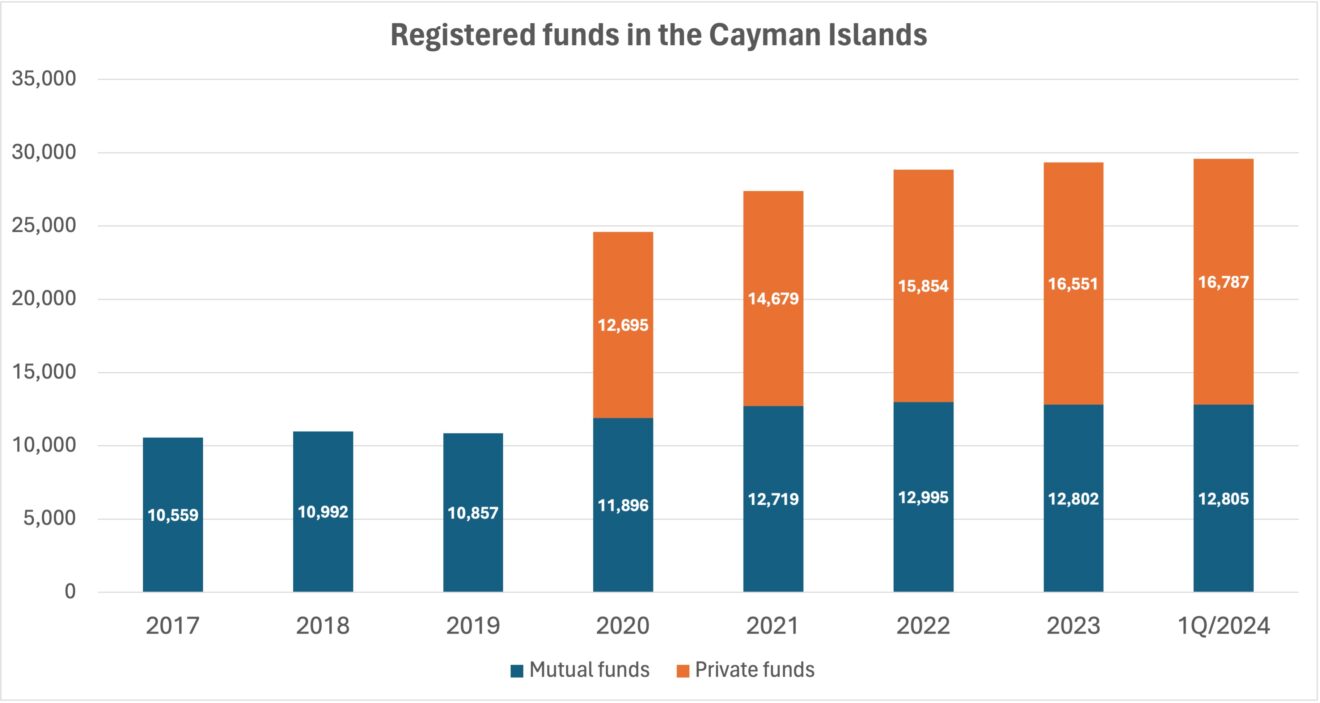

Private fund formations outweigh small decline in registered mutual funds

The Cayman Islands’ funds industry continued to thrive despite difficult market conditions in 2023. The total number of Cayman mutual and private funds grew by 504 (1.7%) to 29,353 during the year. An increase in registered private funds by 697 (4.4%) to 16,551 outweighed a decline of 193 mutual funds (-1.5%) to 12,802 by the end of 2023.

In the first quarter of 2024, the mutual funds numbers stayed flat at 12,805, while the total number of private funds registered grew again by 1.4% (236) to 16,787.

Funds domiciled in the Cayman Islands managed more than half (52.7%) of SEC-registered hedge funds’ net assets and 28.1% of the net asset value of SEC registered private equity funds in the first quarter of 2023, the SEC reported.

According to CIMA’s investment survey, released in Jan 2024, Cayman funds managed about $8 trillion in net assets in 2022, down from $8.5 trillion in 2021.

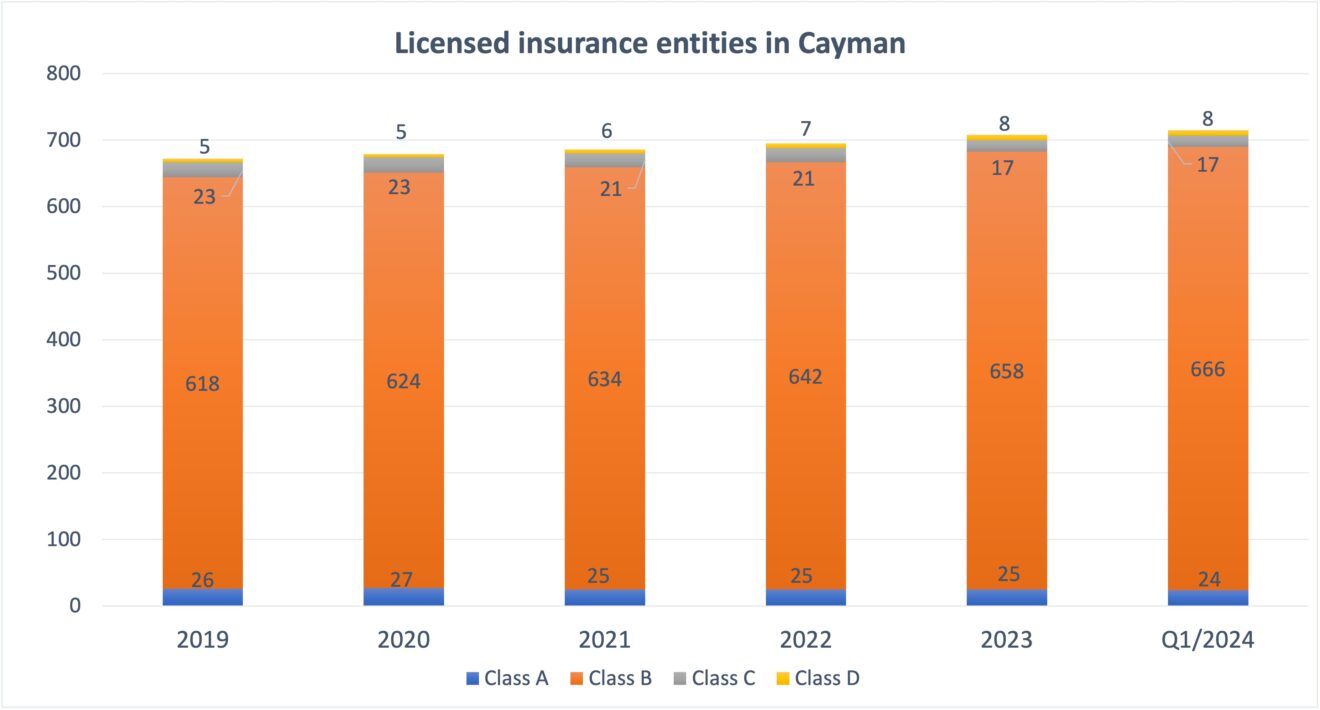

New international insurance licence issuance at decade-high

Insurance activity was high, driven especially by exceptional growth in reinsurance. CIMA issued 41 new international insurance licences in 2023 – the largest number issued in a single year in more than a decade. Between October and December 2023 alone, CIMA issued 15 new international insurer licences.

There were 683 Class B, C and D insurance companies licensed in Cayman at the end of last year – the highest total since 2018. In addition to eight reinsurance companies that have their own offices and staff on island, at least 80 reinsurance vehicles are B(iii)-licensed captives run with the help of local insurance managers.

This trend continued in the first quarter 2024 when CIMA issued eleven new international insurer licenses – four B(i)s and seven B(iii)s.

Banking licenses continue to fall

The number of banks in the Cayman Islands continues to drop. While Class A bank and trust licences, those allowed to offer services to local clients, remained at 11 throughout 2023, Class B banking licenses dropped by seven, or 7.4%, to 87. This compares to 133 Class A and B banks five years ago at the end of 2018 – a decline of 34.6%.

The continuous drop since the late 1990s, when there were more than 500 banks licensed in Cayman, is a result of banking consolidation, increased compliance costs and other regulatory changes that have made operating offshore banks less cost effective.

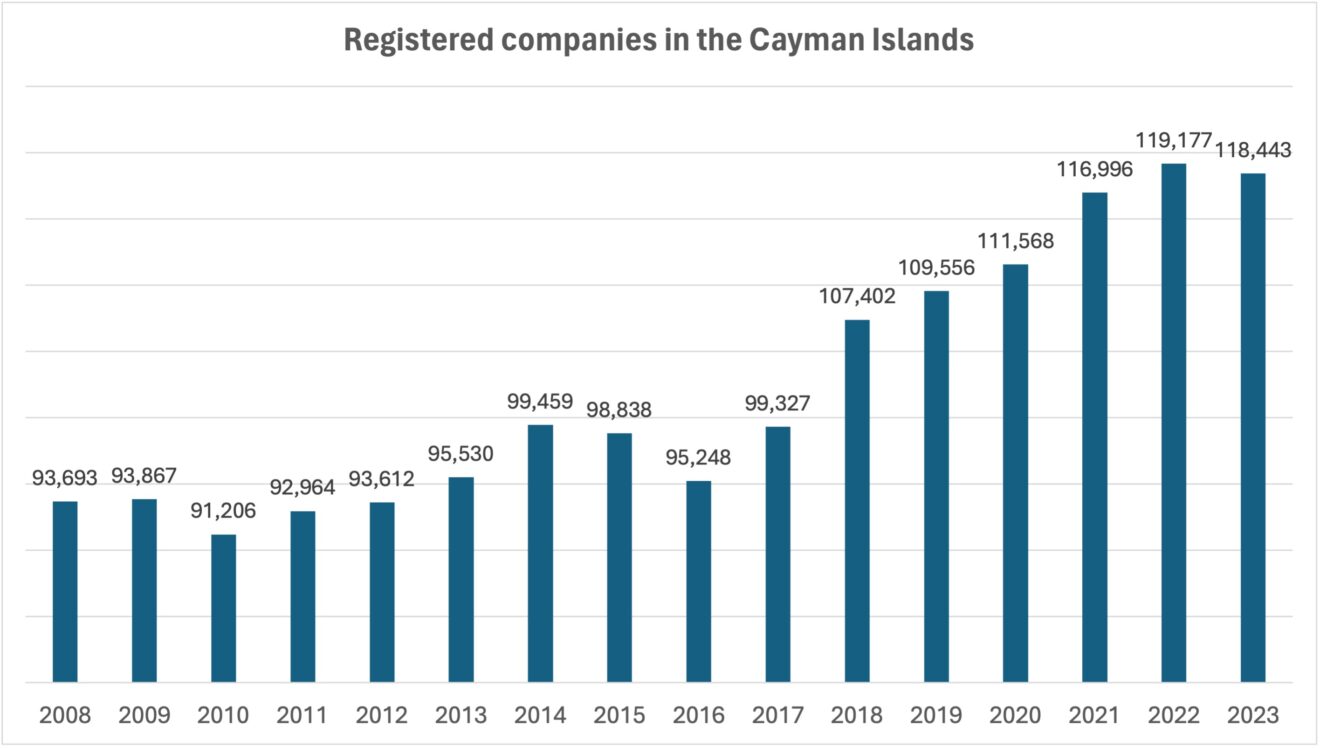

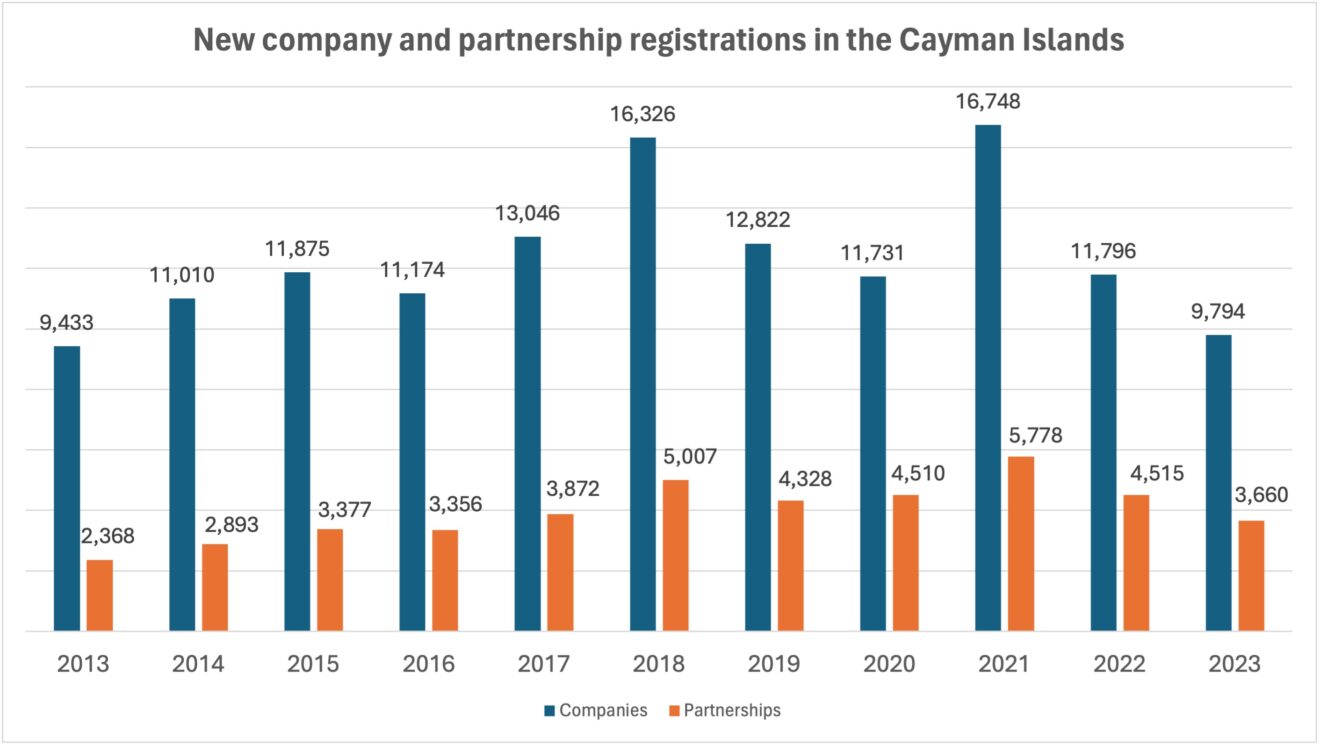

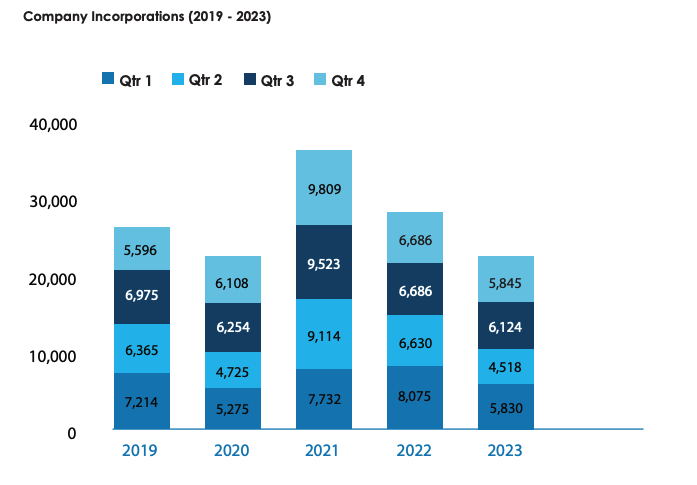

Company and partnership registrations see slowing growth

There were 118,443 companies active in the Cayman Islands at the end of 2023. This represented a small decline of 0.6%, or 734 companies, compared to the previous year’s record high.

Although 9,794 new registrations exceeded official terminations of 9,276 companies throughout the year, additional companies were struck off the register.

New company formations were at the lowest level in a decade.

Nevertheless, specific entity types like foundation companies saw continued demand. They are a popular tool for private wealth purposes and in the virtual asset and Web3 space. The 231 foundations and foundation companies added by General Registry last year reflect Cayman’s position as a leading domicile for decentralised autonomous organisations (DAOs), for which foundation companies are the ideal vehicle.

Segregated portfolio companies, used in the funds, insurance and structured finance space, maintained strong growth with 339 new formations in 2023. SPCs make up 23.4% of captive insurers, 13.6% of mutual funds and 3.3% of private funds.

Partnership registrations mirrored the company formation activity with a decline compared to the previous six years. The 3,660 new partnerships registered last year were significantly lower than 4,515 partnerships added in 2022 and 5,778 new partnership formations in 2021.

On a net basis, the number of active partnerships continued to grow to approximately 38,000. However, final termination figures have yet to be released by General Registry.

The British Virgin Islands, the leader for offshore company formations, experienced a similar slowdown in demand. The 22,317 newly-registered BVI companies in 2023 represented a 25-year low. The total number of active companies in the BVI declined marginally from 367,672 in 2022 to 361,491 in 2023.

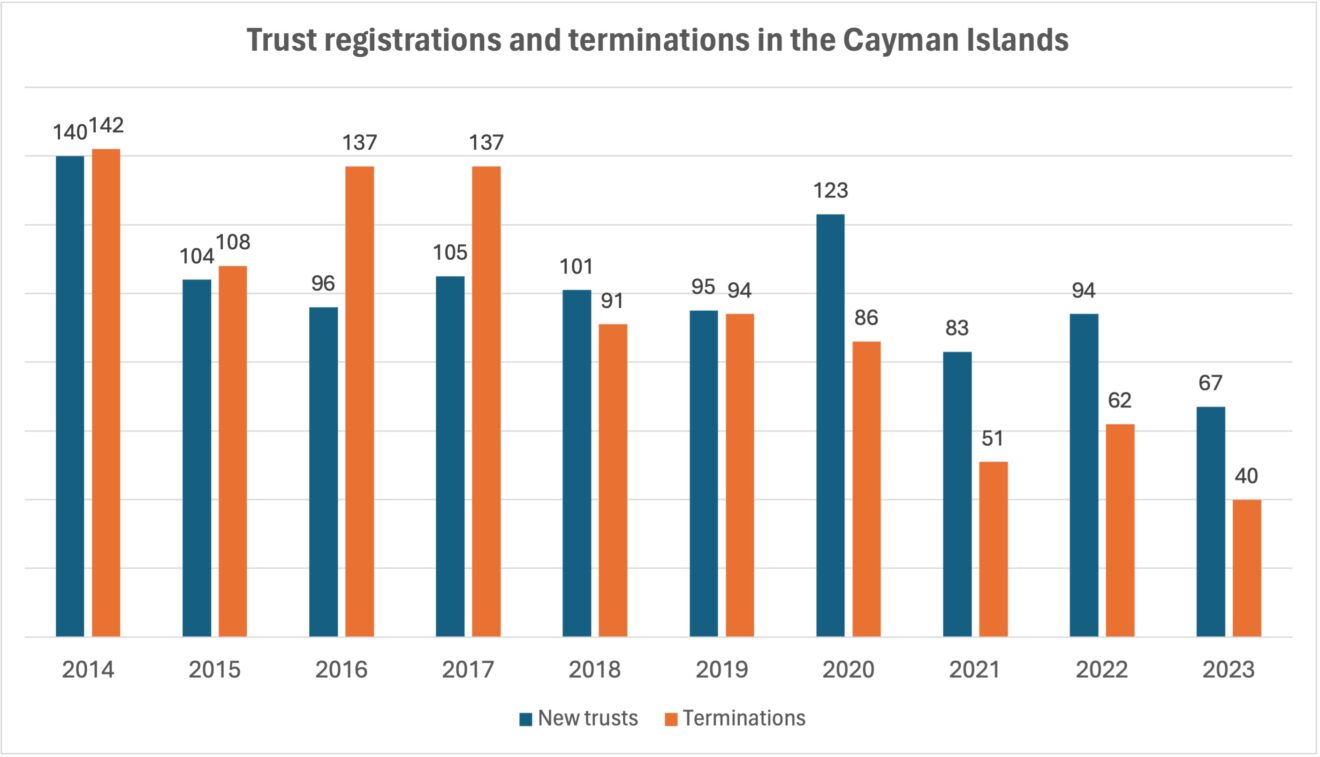

Trusts

New trusts registrations slowed similarly to the levels of activity seen for companies and partnerships. The number of newly added trusts to the Cayman Islands register has exceeded terminations in each of the past six years.