Danielle Roman and Natasha Groves, Mourant

The Cayman Islands is a leading offshore jurisdiction for commercial aircraft financing and leasing transactions. Tax neutrality, combined with a commercially flexible civil aviation authority and depth of expertise makes the Cayman Islands a market leader in the structuring of such transactions. Airlines, operating lessors and lenders have grown familiar with the typical ‘off-balance sheet’ or ‘orphan’ structures, affording bankruptcy remoteness of the underlying asset.

The extension of the Cape Town Convention on International Interests in Mobile Equipment and the associated Protocol on matters specific to Aircraft Equipment (the Cape Town Convention) to the Cayman Islands re-enforces the jurisdiction’s sophisticated aircraft finance capability.

What is an SPV?

A special purpose vehicle (SPV) is a legal entity set up for a limited purpose. In the case of aircraft finance this is usually to own (and/or lease) an aircraft for a specific transaction. SPVs are highly flexible corporate structures that can be utilised either to own a single aircraft or to hold multiple aircrafts and are considered a particularly useful structuring tool for airlines, operating lessors and lenders in cross-border aviation finance transactions. There are two basic structures that are commonly used in aircraft financing and leasing transaction: (i) an on-balance sheet direct ownership structure and (ii) an off-balance sheet, insolvency remote or ‘orphan trust’ structure.

‘On-balance sheet’ SPV structure

- Airline/operating lessor will establish a wholly-owned SPV to acquire the aircraft;

- Airline/operating lessor will remain shareholder of the SPV;

- Airline/operating lessor will typically act as, or provide, directors to the SPV; and

- SPV will form part of the airline/operating lessor’s group structure and be included on the group’s balance sheet.

‘Off-balance sheet’ SPV structure

- An SPV will be established by the airline/operating lessor;

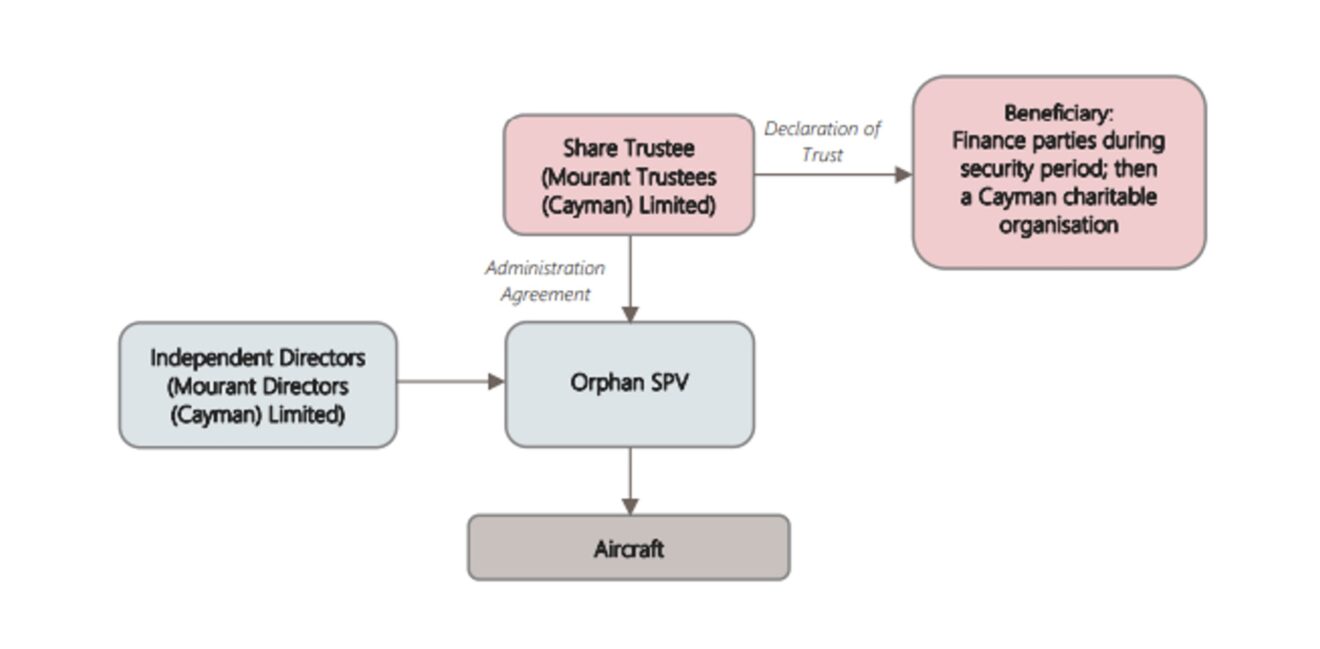

- Shares in the SPV are held by an offshore trust company or as share trustee pursuant to a trust structure;

- The directors of the SPV will usually be provided by a third-party corporate administrator (often same entity as the share trustee);

- SPV will be legally separate from the other transaction parties, including the underlying entity operating and deriving income from the aircraft; and

- The right of any charitable beneficiaries to receive any benefit from the trust will be contingent on there being a surplus at the end of the transaction (ie after all of the liabilities of the SPV, including any loan to finance the purchase of the aircraft, are settled in full) on the winding up of the SPV, by way of distribution.

Using a Cayman Islands orphan SPV in aircraft financing transactions

When using a Cayman Islands orphan SPV structure in an aircraft financing transaction, the issued shares in the SPV are held in a trust structure. It is important to ensure that there is some benefit to the trust to avoid the trust being potentially treated as a sham. This is usually achieved by an equity contribution of an amount (often nominal) to the SPV and the cash flows configured to ensure that this remains available for distribution to the beneficiaries of the trust at the end of the transaction.

The integrity of the transaction is preserved by ensuring that the trustee has certain restrictions placed on its powers and discretions in the trust deed. For example, the trustee will be restricted from disposing of the shares in the SPV, winding the SPV up or taking any action which is outside the scope contemplated under the transaction documents which the SPV has entered into.

The SPV will enter into the financing/leasing documents necessary to enable it to acquire or lease the aircraft and therefore holds the title to the aircraft and is the recipient of the financing. To secure its obligations in respect of the financing, the SPV will grant certain security in favour of the lender which may include a mortgage over the aircraft, a security assignment and an account charge, while the share trustee will provide the lender with security over the shares in the SPV. Following the termination/maturity of the transaction and satisfaction of all of the secured obligations, the trust will terminate and the trust property (being the issued share capital of the SPV and any transaction fees received by the SPV, less expenses) will be distributed by the trustee to the beneficiaries.

Advantages

Limited liability

Under Cayman Islands law, the SPV has a separate legal personality, therefore a shareholder cannot become liable for the acts of the SPV (only in very limited circumstances can a claimant bring a claim against the shareholder, eg fraud or wilful default on the part of the shareholder). Parties therefore limit their personal liability as the recourse of lenders is limited to the aircraft and the supporting security granted by the SPV over any other assets.

Greater control for lender

As security for the financing, the share trustee will usually grant a share mortgage over the shares held in the SPV, which the lender can enforce upon the occurrence of an event of default and therefore take control of the SPV and the underlying aircraft asset. This enables the lender to either transfer the SPV as a going concern or directly sell the aircraft.

Off-balance sheet

Using an orphan trust structure creates a level of separation between the lender, airline/operating lessor and the trustee who can take comfort that the aircraft subject to the financing should not affect it from an accounting perspective, given the SPV does not form part of any of their respective group structures.

Bankruptcy remoteness

Achieving a bankruptcy remote structure is a key benefit of an orphan trust structure. The purpose of bankruptcy remoteness is to ensure that the SPV will not be affected by the insolvency of any of the other transaction parties. Conversely, the transaction parties are protected if the SPV itself becomes bankrupt. This is partly achieved through the off-balance sheet treatment discussed above, however, there are two other key critical elements which would need to be addressed in the transaction documents, namely:

- limited recourse provisions; and

- non-petition provisions.

Limited recourse

Limited recourse provisions operate to ensure that the recourse of lenders will be limited to the aircraft and any other supporting security provided by the SPV. To the extent there is any shortfall to meet any claim or obligation, any such claim will be extinguished against the SPV and such shortfall will be borne by the other relevant transaction parties.

While there is no current direct judicial authority in the Cayman Islands with respect to such limited recourse provisions:

- a contractual provision which provided for the extinguishment of a secured debt after exhaustion of the assets on which that debt was secured will be valid, binding and enforceable as a matter of Cayman Islands law (assuming that the provision was valid, binding and enforceable under the law governing the contract in which it was contained); and

- after the extinguishment of the secured debt, the secured creditor would not have standing to make a claim against the SPV in respect of the debt, whether for its repayment, the winding up of the SPV or otherwise.

Upholding non-petition

The transaction parties of the aircraft financing transaction will usually agree that they will not take any steps or present any petition against the SPV for its liquidation. This is to ensure that none of the parties take any action to wind-up the SPV during the life of the transaction.

This contractually agreed position is expressly recognised by statute in the Cayman Islands pursuant to section 95(2) of the Companies Act of the Cayman Islands (as amended) which states that the ‘Court shall dismiss a winding up petition or adjourn the hearing of a winding up petition on the ground that the petitioner is contractually bound not to present a petition against the company’.

As such, the courts of the Cayman Islands must dismiss a winding up petition against an SPV or adjourn any hearing of a winding up petition against an SPV, if the petitioner has contractually agreed not to present a winding up petition against that SPV.

How to set up and manage a Cayman Islands orphan trust

In any orphan trust structure, it is important to note that parties to the transaction should not seek excessive control of the SPV as, to do so, could undermine the trust structure. It could also lead to a range of other commercial risks arising, including it being construed as a shadow director of the SPV or the SPV being disregarded as a separate legal entity.

Further, all parties involved in the transaction should obtain professional legal and tax advice within the relevant jurisdictions before setting up an orphan trust structure.

An orphan trust can typically be established by setting up one of the following trusts:

Charitable trust

Shares in the SPV will be issued to a licensed trustee which:

- is established in the Cayman Islands and which is completely independent from the lender or airline/operating lessor, helping to ensure that no conflict of interest arises between the parties;

- will hold the legal title to the shares in the SPV; and

- will establish a charitable trust structure by declaring a trust over the shares issued by the SPV for the benefit of a charitable organisation in the Cayman Islands.

This arrangement will make the SPV ‘orphan’ in nature given that the shares of the SPV form part of the trust assets of the charitable trust and are not owned by the lender or the airline/operating lessor.

STAR trust (purpose trust)

Similar to a charitable trust, the shares in the SPV will be issued to a licensed corporate trustee, however, the purpose trust (known as a STAR trust in the Cayman Islands) is created for a specific purpose and will be held on behalf of a residuary beneficiary (which is usually a Cayman Islands charity). The purposes of the STAR trust will be set out in a trust deed and will typically be to subscribe for the shares in the SPV and to carry out the obligations of the SPV under the trust documents and related transaction documents.

One of the key differences between a STAR trust and a charitable trust is that an ‘enforcer’ can be appointed pursuant to the trust deed of a STAR trust whose role is to ensure the trustee of the STAR trust carries out its obligations. The enforcer does not need to be resident in the Cayman Islands and the lender can act in this role, making it an attractive option particularly if there are any concerns as to the execution of the trustee’s powers by the lender or the airline/operating lessor

Administration

An SPV needs to appoint a number of service providers in administering the trust structure and to ensure its independence and to enable its effective operation, including:

- share trustee;

- independent director(s); and

- registered office provider.

There are a range of corporate service providers based in the jurisdiction which provide these services, including MGS.

Danielle Roman is a Partner at Mourant Ozannes (Hong Kong) LLP and Practice Leader of the firm’s Hong Kong Banking and Finance team.

Natasha Groves is a Senior Associate in Mourant Ozannes’ (Hong Kong) LLP’s Corporate and Finance practice.