Long known as a leading captive insurance domicile, the Cayman Islands has significantly grown its role as a hub for reinsurance.

For the past six years, the Cayman Islands reinsurance sector has posted double-digit annual growth rates and dozens of reinsurers have obtained a licence from the Cayman Islands Monetary Authority (CIMA).

Some of these developments have been more visible than others because Cayman’s reinsurance businesses fall into one of two licensing categories.

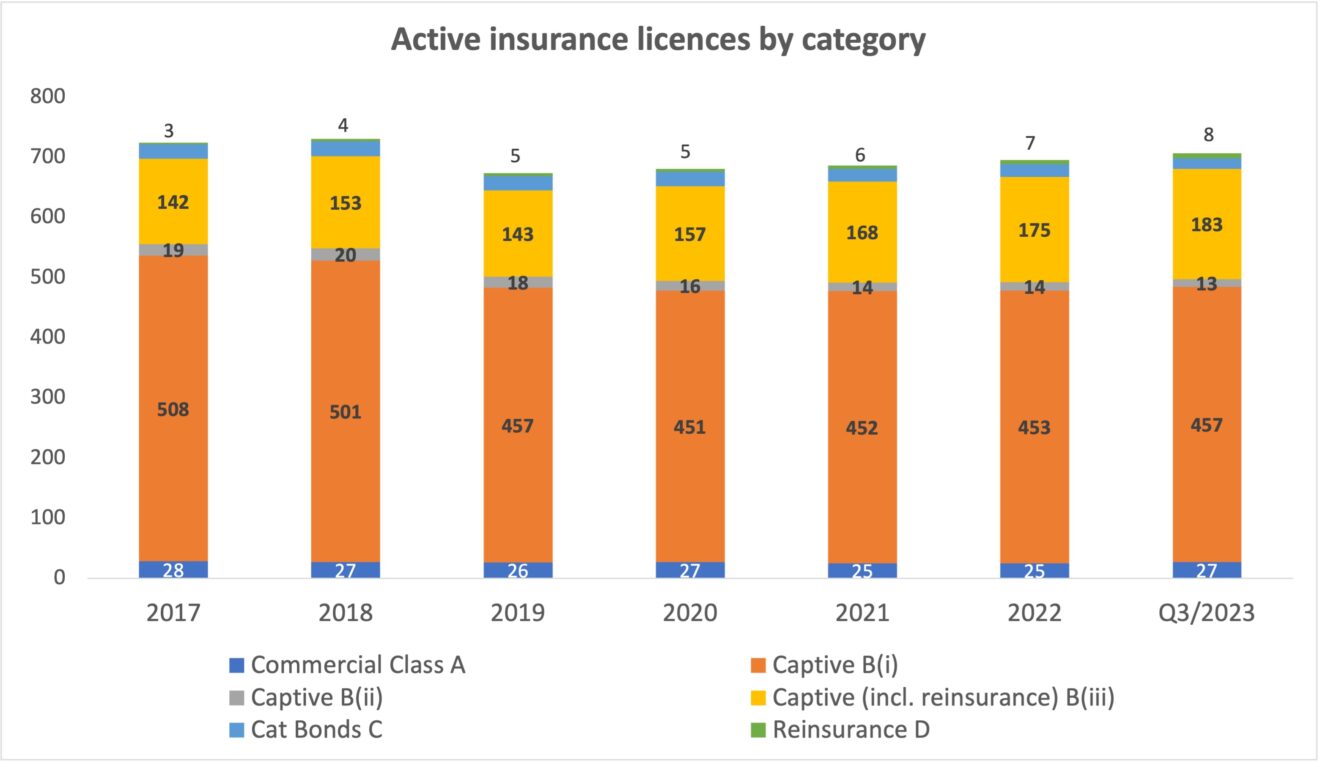

Class D reinsurance companies have a physical presence on island and operate independently without an insurance manager. Since the end of 2017, the number of these reinsurers with staff and offices in Cayman has jumped from three to eight.

Nine times more reinsurance vehicles can be found within CIMA statistics as a subset of Class B(iii) licensees.

There are, as of September 2023, 183 active Class B(iii) insurance licences, up from 143 in late 2019. Class B licences cover captive insurers, and a Class B(iii) licence is for insurance companies that derive most of their non-domestic insurance business from third parties.

It is also used by captive reinsurance platforms that, as Class B(iii) licensees, are not required to have a physical presence but must appoint an insurance manager.

CIMA reported that at the end of the third quarter 2023 there were 80 reinsurance vehicles registered in Cayman. The reinsurance sector accounted for $42.7 billion in premiums and $81.4 billion in assets. It makes up 11% of all insurance entities, 74.2% of premiums and 59.4% of total international insurance industry assets.

Although, there are fewer Class D reinsurers, they have an outsized impact on the economy, given that they rent office space, employ staff locally and pay a licence fee that is ten times larger than that of their Class B(iii) captive reinsurance counterparts.

Nevertheless, captive reinsurance is a significant business for local insurance managers, who provide accounting, administrative and other management services.

The islands remain the leading domicile for healthcare captives and have seen consistent demand for captive insurance, amid stable licensing activity.

Yet, much of the recent growth in insurance licenses has come from reinsurance entities and the Class B(iii) license category.

While before 2016, the reinsurance sector was dominated by property and casualty reinsurers, it has since attracted a growing number of life & annuity businesses. The 27 licensees that have life as a primary class of business account for 4% of all Cayman international insurance licensees, $33.1 billion of premiums and $64 billion of assets.

Reinsurance entities include both standalone start-ups and affiliates of established carriers that complement existing operations elsewhere.

Flexible management of regulatory capital

There are several reasons for this increase in reinsurance formations.

With the introduction of the European Union’s Solvency II prudential regime for insurance and reinsurance in 2016, non-EU insurance centres had to decide whether to implement equivalent capital requirements to be able to offer insurance services in Europe.

Reinsurance domiciles like Bermuda, which has a significant European share of business, opted for Solvency II equivalency. This created additional costs for US-focused and other non-European global reinsurance programmes in terms of higher regulatory capital ratios, investment restrictions and operating costs.

Cayman’s financial services sector is predominantly US-facing and 90% of all insured risks are North America based. Correspondingly, Cayman elected not to pursue Solvency II equivalency, offering prospective reinsurers a flexible and less prescriptive legislative and regulatory regime.

This allows reinsurers to adopt bespoke capital models that are more proportionate to their specific business, while still meeting minimum capital requirements.

Cayman’s balanced regulatory approach and flexibility in managing regulatory capital is further reinforced by the availability of world class service providers on island.

The stable political and economic environment, supportive immigration rules, and certainty with respect to Cayman’s tax regime are other important factors driving reinsurance.

For instance, in terms of the global minimum corporation tax, the Cayman Islands government has made clear that it does not intend to levy a 15% qualified domestic minimum top-up tax and will remain completely tax neutral. Cayman will comply with the minimum tax by cooperating and exchanging tax information with international tax authorities.