Michael Klein

The rules are not yet fully agreed but governments around the world are already thinking about how they will spend an expected windfall in additional corporation tax levied on subsidiaries in low-tax jurisdictions.

Treasuries are currently estimating how much additional corporate tax revenue the new global minimum corporate tax rate of 15% will bring.

The OECD conceived the top-up tax that will let tax authorities in a multinational’s home jurisdiction claim anything that remains untaxed on the income of subsidiaries overseas up to a rate of 15%.

The Paris-based organisation claims according to its economic impact assessment the new tax could generate about $220 billion each year in new tax receipts. This would be equivalent of 9% of global corporate tax revenues or comparable to the total US corporate tax receipts in 2019 and 2020.

That may be an overestimate because the OECD analysis used up to five-year old data.

The last decade has seen a general worldwide tightening of transfer pricing regulations, controlled foreign corporation rules, cross-border debt structuring and anti-hybrid rules.

The United States introduced its on Global Intangible Low Tax Income (GILTI) and the Base Erosion and Anti-abuse Tax (BEAT).

Last year, the U.S. adopted a new corporate alternative minimum tax on multinationals. This is different from the global minimum tax, but it does affect how much tax corporations have to pay.

The total intake from the global minimum tax may also be reduced by administration and compliance costs incurred by tax authorities.

The International Monetary Fund has forecasted a lower estimated revenue impact of the new levy and believes international corporate tax receipts will go up by 5.7%.

IMF simulations calculated that 18.5% of global MNE profits, about $1.47 trillion in 2019, are taxed below 15%. On average, the current tax rate on these profits is 5%, so that profits exceeding the substance-based income exclusion would be subjected to an average top-up tax of 10%.

This is, however, before factoring in any behavioral changes such as low-tax countries implementing the tax, as well as reduced profit shifting and less tax competition.

Individual country estimates range from 2% to 12%

So far, eight countries have produced individual estimates of how much corporate tax revenues will increase, ranging from 2% in the Netherlands to up to 12% in France.

Belgium seeks to raise between US$722 million and $853 million each year between 2024 and 2026. This would equate to an average 4% increase in corporation tax revenue.

Canada initially believed its tax reform attempts would bring in US$6 million or 9% in additional corporate tax revenues each year. This was recently corrected to new revenue of C$2.8 billion (US$2.1 billion) in fiscal 2027 and C$2.4 billion (US$1.8 billion) in fiscal 2028.

Denmark expects to gain $300 to $400 million, or 3% to 4% more than currently, in corporation tax paid.

In Germany, the IFO Institute, an economic thinktank, estimated in 2022 the new tax could provide a windfall of US$5.8 to US$7.6 billion, about 8% to 10% of Germany’s overall corporate tax intake, each year. However, the German Finance Ministry released its projection in July 2023 forecasting much lower additional tax revenues of EUR910 million (US$1 billion) for 2026. In 2027, it foresees EUR535 million in additional revenues and in 2028, EUR285 million euros.

UK estimates are somewhat lower. According to budget scenarios, the minimum tax is expected to draw about £335 million ($417 million) in revenue during 2023-24. This could rise to £2.26 billion (US$2.81 billion) in the fiscal year 2027-2028, or about 4% more than the average intake pre-Covid.

The French government projected this year the minimum tax would boost the country’s revenue by at least $1.1 billion per year (1.5%).

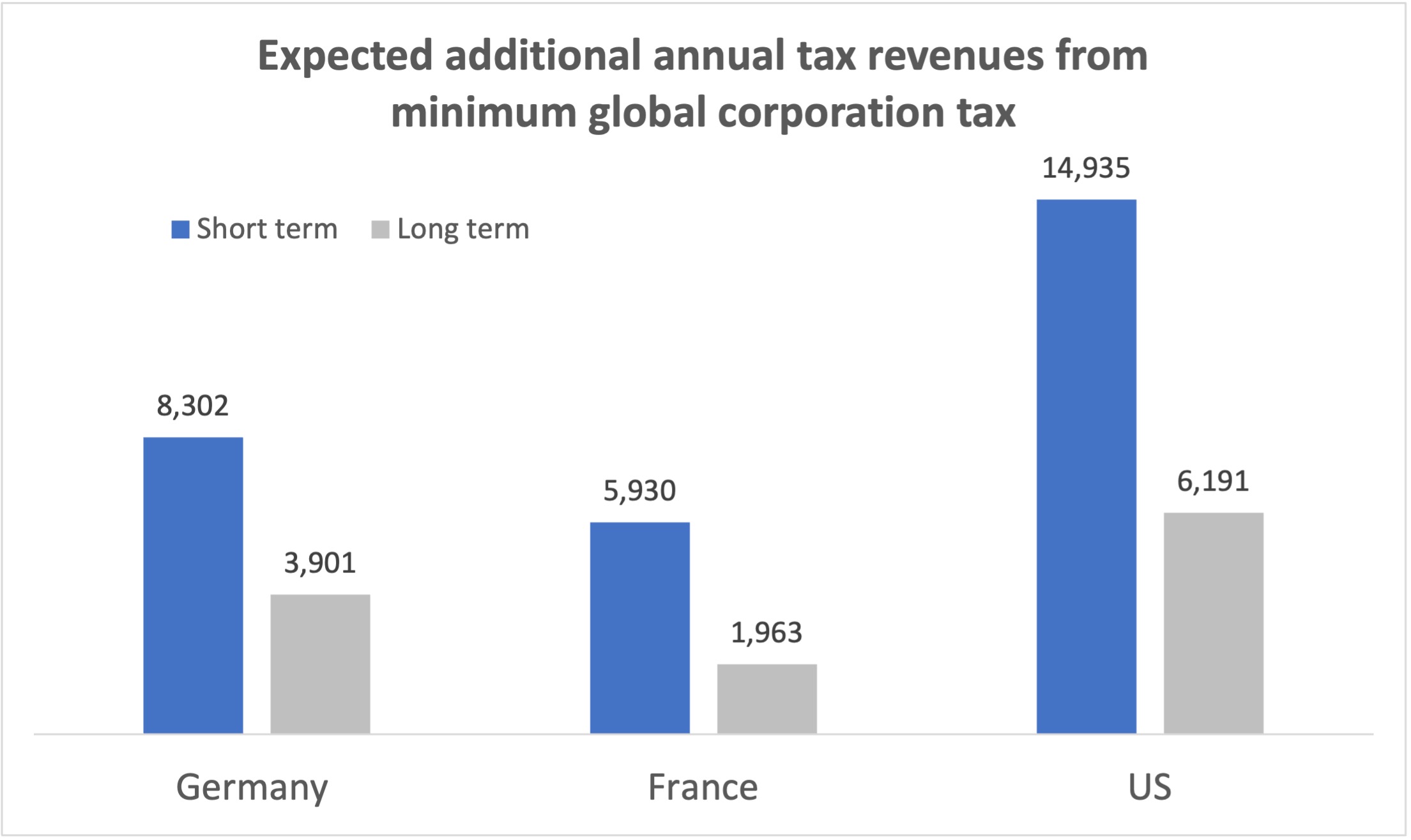

The Council of Economic Analysis in France projected in June 2021 the minimum tax would initially raise US$6.8 billion per annum but that amount could drop to US$2.28 billion after a few years, because low-tax jurisdictions have an incentive to raise their tax rates to capture the tax revenue themselves.

The increase would range between 3% and 12% based on France’s current corporate tax receipts.

The same analysis projected significantly higher initial revenues for Germany of EUR8.3 billion (US$9.1 billion) that would decrease to EUR3.3 billion (US$3.6 billion).

The United States is by far the largest beneficiary of the minimum tax according to the study with EUR14.9 billion (US$16.3 billion), although that figure would decline to EUR6.2 billion (US$6.8 billion) after a few years.

The US Congressional Joint Committee on Taxation, in contrast, released a report in June that explained revenue effects of the global minimum tax were difficult to predict due to the uncertainty how countries are going to implement it and how corporations react to it. Depending on whether US multinationals shift their taxable profits to Pillar Two-compliant countries or to the United States, the effect on federal tax receipts could range from a loss of $174.5 million to a gain of $224.2 million over a ten-year period from 2023-2033.

The French study suggests that about two-thirds of the taxable profits of US, French and German multinationals are found in Switzerland, the Netherlands, Ireland and Luxembourg, with the remainder in Hong Kong, Singapore and offshore financial centres.

Ironically, the Netherlands and Switzerland also expect to gain from the minimum tax.

The Netherlands estimated a projected revenue of EUR400 to EUR 500 million during a public consultation last year. Meanwhile, Switzerland’s Federal Council has proposed an additional tax to implement Pillar 2, which is project to yield CHF1 billion to CHF2.5 billion per year (US$1 to US$2.6 billion) in additional revenue – a 4% to 11% increase.

Taken together the top end estimates for Belgium, Canada, Denmark, France, Germany, the Netherlands, Switzerland, the UK and the US would amount to about $37.9 billion of additional annual corporation tax revenues, significantly below the OECD’s global $220 billion estimate.