Michael Klein

The US Federal Reserve’s interest rate hikes since 2022, in contrast to consistently low rates in Japan, have posed a dilemma for Japan’s financial market investors. And with it for investments routed through Japan’s number one location for overseas asset purchases over the past decade: the Cayman Islands.

Market observers are speculating that new leadership at the top of Japan’s central bank and the new global interest rate environment will lead to a change in monetary policy that will see a large share of Japanese investments overseas return home.

Before Haruhiko Kuroda took charge of the Bank of Japan in 2013, Japanese investors rarely looked abroad. This changed when the central bank introduced a negative interest rate policy as part of its quantitative easing programme in January 2016.

Under this policy, the BOJ began to charge a negative interest rate of -0.1% on excess reserves held by commercial banks at the central bank and suppressed long-term bond rates.

The prolonged period of ultra-low interest rates was designed to stimulate the economy by encouraging banks to lend more to businesses and households. It also depreciated the yen, making Japanese exports more competitive.

At the same time it punished long-term savers and made it harder for investors to achieve the returns they were looking for.

In 2017, Japan’s Government Pension Investment Fund, the world’s largest pension fund, first expressed its intention to allocate more assets to alternative investments outside of Japan.

Other institutional investors followed suit.

During Kuroda’s reign as BOJ governor, which ended in April 2023, when Kazuo Ueda took over, Japan made about $3.4 trillion in overseas investments.

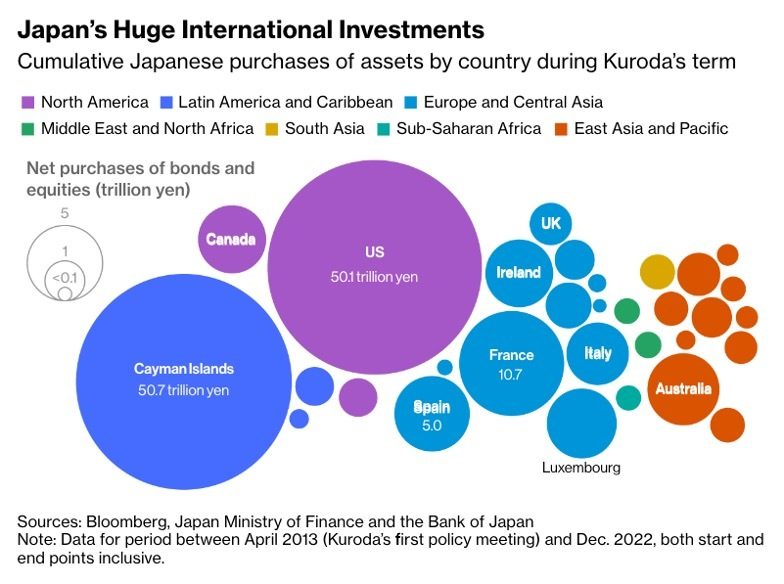

Bloomberg reported in April, based on data from Japan’s Ministry of Finance and the country’s central bank, net purchases of bonds and equities by Japanese investors via Cayman amounted to 50.7 trillion yen, about US$380 billion, during Kuroda’s term.

This put the Cayman Islands slightly ahead of the United States, with 50.1 trillion yen, and represented almost five times the amount of assets bought in France, the third main destination for net asset purchases.

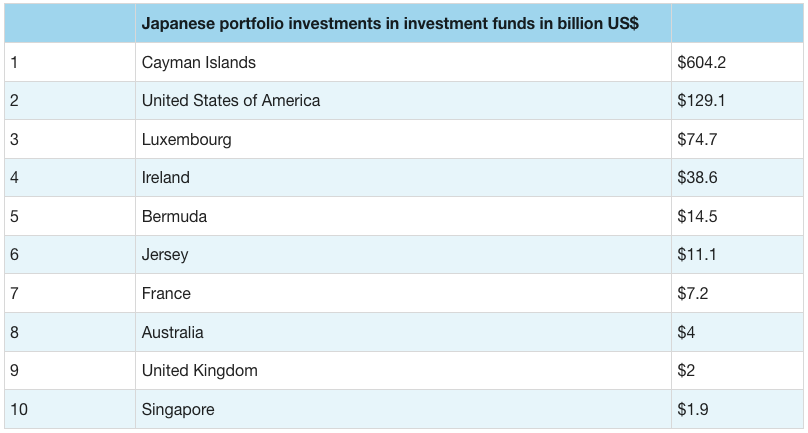

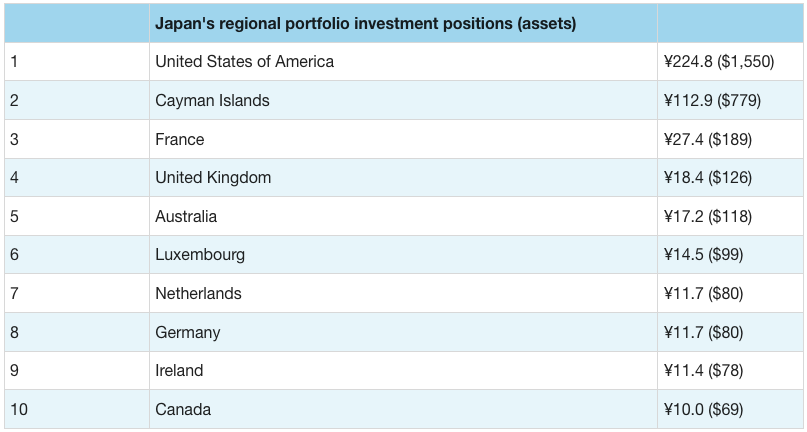

The Cayman Islands currently attracts more than two thirds (67.3%) of Japanese investments in overseas investment funds.

At the end of 2022, Japanese holdings in Cayman Islands investment funds amounted to 87.6 trillion yen ($604.2 billion at the current exchange rate).

Overall, Japan is the second most important source of portfolio investments for the Cayman Islands with $779 billion in assets, trailing only the United States which had $2.59 trillion in assets invested in Cayman investment vehicles in June 2022, according to data reported to the International Monetary Fund (IMF).

Why Cayman?

While Japanese investors also use Luxembourg’s common funds, Cayman Islands unit trusts became the vehicle of choice for both Japanese investment managers and investors.

US managers seeking to raise capital from institutional investors in Japan also often deviated from their traditional Cayman exempted limited partnership model to attract Japanese capital, with some offering bespoke private equity and real estate funds and more liquid managed funds.

Japanese investors have long used domestic investment trusts and are more familiar with a structure that includes an independent professional trustee overseeing and governing the fund and as an independent fiduciary holding the legal title to the fund’s assets.

The Cayman Islands investment trust benefited from its structural similarity to the domestic Japanese investment trust, the fact that it can be deployed quickly, and that, like Japanese investment trusts, it is treated as tax-exempt and capital gains and income are not taxed. Instead, Japanese investors in a collective investment trust are subject to relevant withholding taxes in relation to profit distribution.

As such Cayman investment vehicles have provided an accustomed and often higher-yielding opportunity for Japanese investors to diversify their portfolios internationally.

Are changes afoot?

Many market observers are now speculating that the country’s easy money experiment will have to come to an end and wonder what it will mean for Japan’s overseas bond holdings and other investments abroad.

Past attempts to normalise interest rates led to major reverberations in the foreign exchange and fixed income markets.

With the yen extremely sensitive to interest rate changes, Japan’s overseas investors are concerned about rising foreign exchange risk and may seek to repatriate their investments.

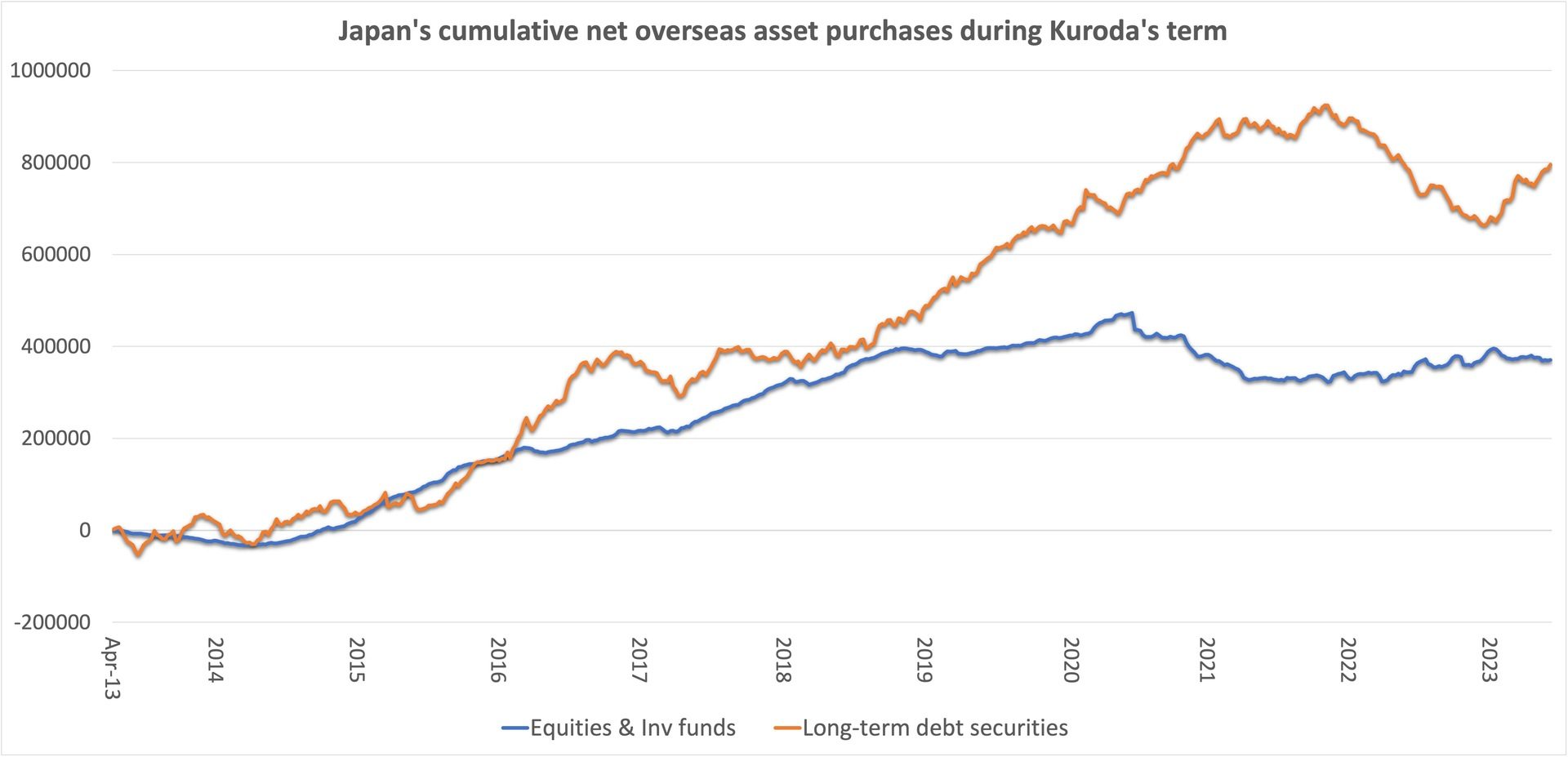

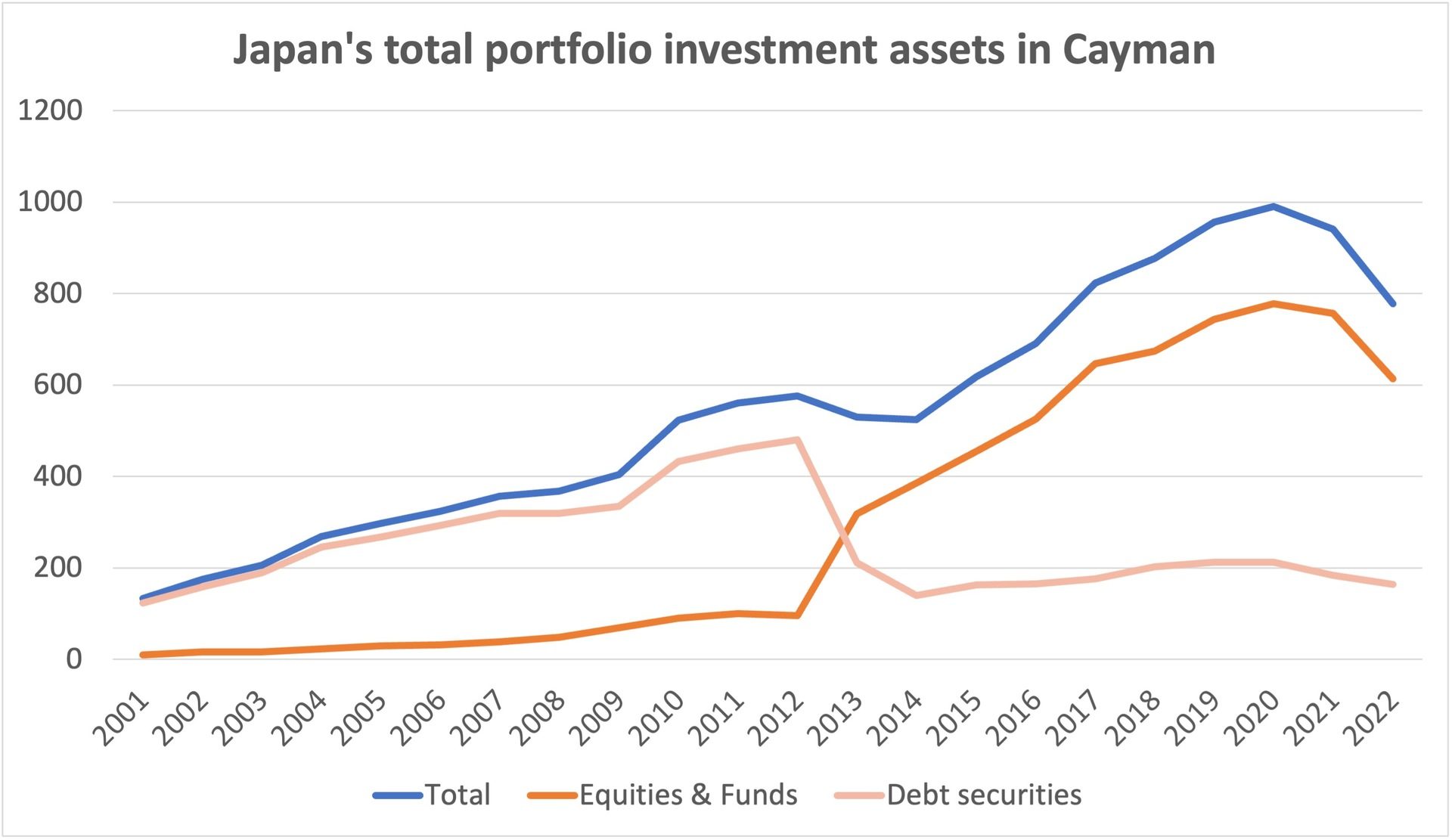

To some extent, this process has already started. Net investments in overseas investments funds dropped from their peak at the start of the COVID pandemic in the second quarter of 2020. They have since stabilised.

Investments in bonds started to fall in the final quarter of 2021 and throughout all of last year when Japanese investors sold a record amount of overseas debt. Many investors were forced to cut their losses as they felt the bite of rapidly rising interest rates and falling bond prices globally in 2022.

However, that trend reversed and recovered half of the decline in 2023.

Source: Japan Ministry of Finance

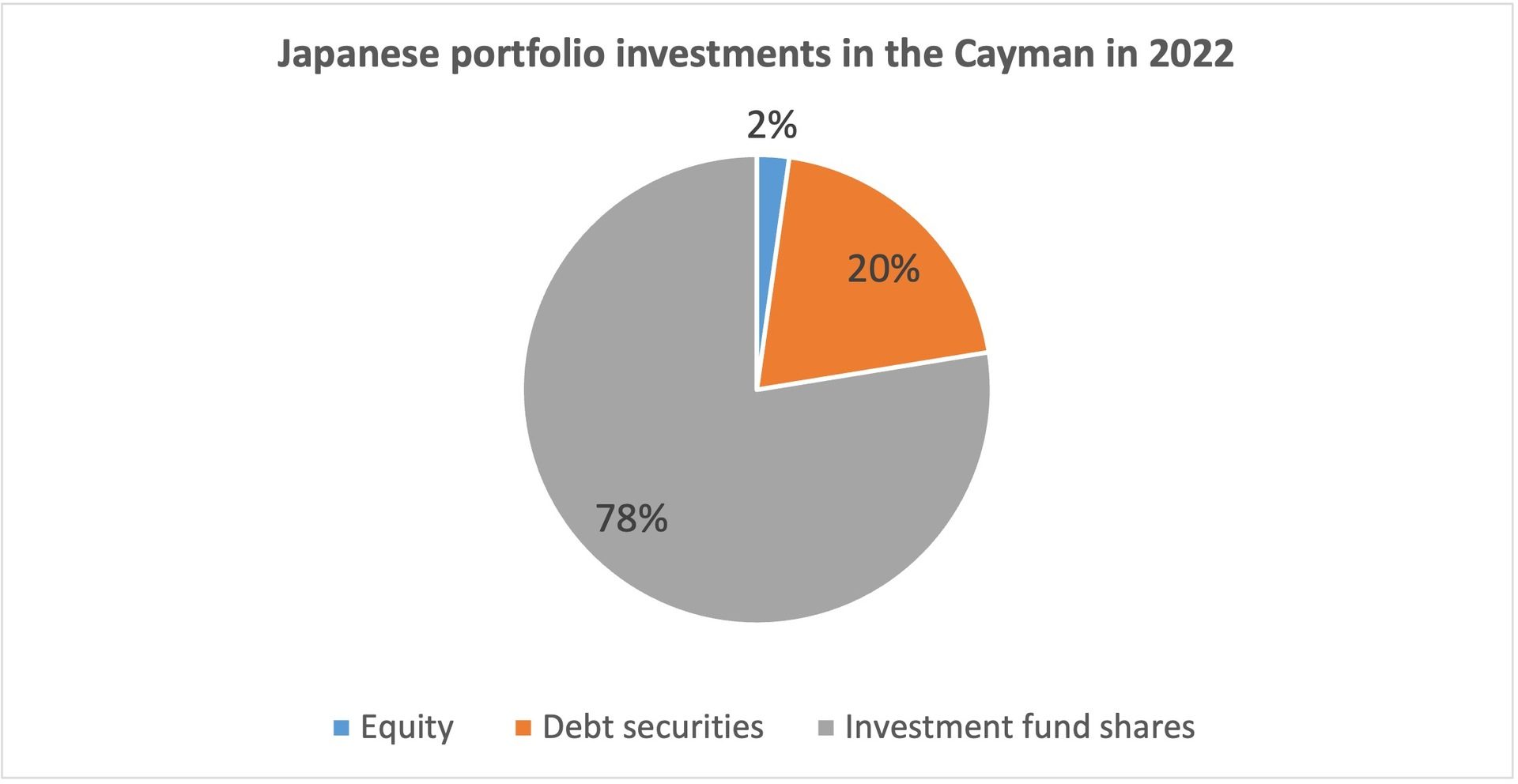

About a fifth of Japanese investments via the Cayman Islands are in bonds (US$157.1 billion), while direct equity investments make up only 2% of all Japanese portfolio investments in the islands.

Source: Japan Ministry of Finance, Regional portfolio investment positions, end of 2022

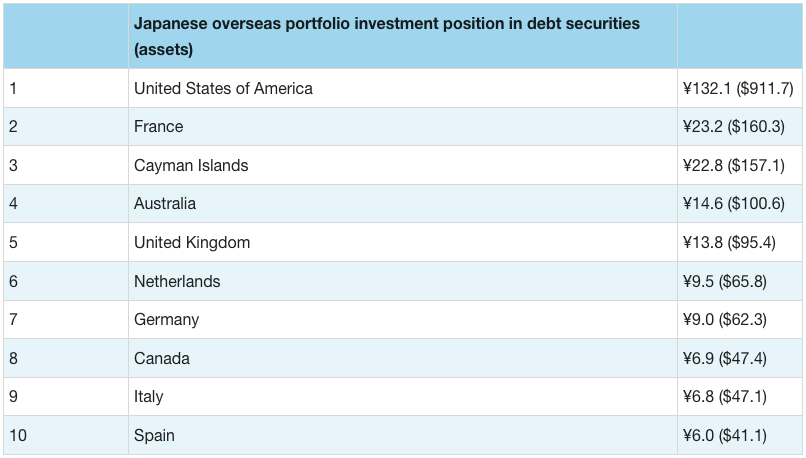

The vast majority of overseas bond holdings by Japanese investors are in the United States followed by France, the Cayman Islands and Australia.

Japan’s consistently low interest rates, compared to the rest of the world, are the main reason the yen fell to a 32-year low this year.

For years, Japanese equities and the yen displayed an inverse relationship, caused by the widespread belief that a cheap yen boosts exports and the larger stock-market listed companies.

The Nikkei index reached a 33-year high this year as Japan outpaced the rest of the world in yen terms.

This gives the country’s retail investors one reason to keep their capital at home rather than invest it overseas to achieve higher yields. Recent tax changes provide another incentive for investors to invest locally rather than abroad.

However, initial speculation that Japan’s central bank would quickly loosen its grip on low interest rates has somewhat subsided.

Central bank governor Ueda has so far shown little appetite for an immediate policy change.

At a meeting of central bank governors at the monetary policy forum in Sinatra, Portugal, in June, Ueda explained that although headline inflation in Japan of 3% is slightly above the target rate, important inflation indicators such as wage increases still have some room to go before the Bank of Japan would have to act.

Japan’s central bank has tried unsuccessfully for years to unlock inflation expectations from zero to the target rate of 2%. Ueda said that while there has been some movement, un-anchoring inflation expectations and then re-anchoring them at 2% will be a formidable task.

A significant change to the current monetary regime may therefore not be on the cards just yet.

Regardless of the monetary policy, Japan is likely to remain a strong foreign investor. In 2021, Japanese businesses earned more in income from dividends, interest and other foreign sources than any other G7 nation, reflecting in addition to portfolio investments a large number of direct investments in the form of corporate acquisitions. The outstanding balance of Japan’s overseas investment assets totalled 1.25 quadrillion yen ($8.65 trillion) at the end of 2021.

However, since the Covid pandemic in 2020, Japan’s portfolio investment assets in Cayman, particularly those in funds, have declined by 21.4%, according to International Monetary Fund data.

Overall, the Cayman Islands remains the second most important target of Japanese investments after the United States. Cayman maintains a share of 19% of Japan’s total portfolio investment assets overseas and will remain well-placed to respond to Japanese investor needs no matter what monetary policy decisions are taken.