The Cayman Islands Monetary Authority licensed eight new captive insurance companies and one new portfolio insurance company in the first quarter of 2023.

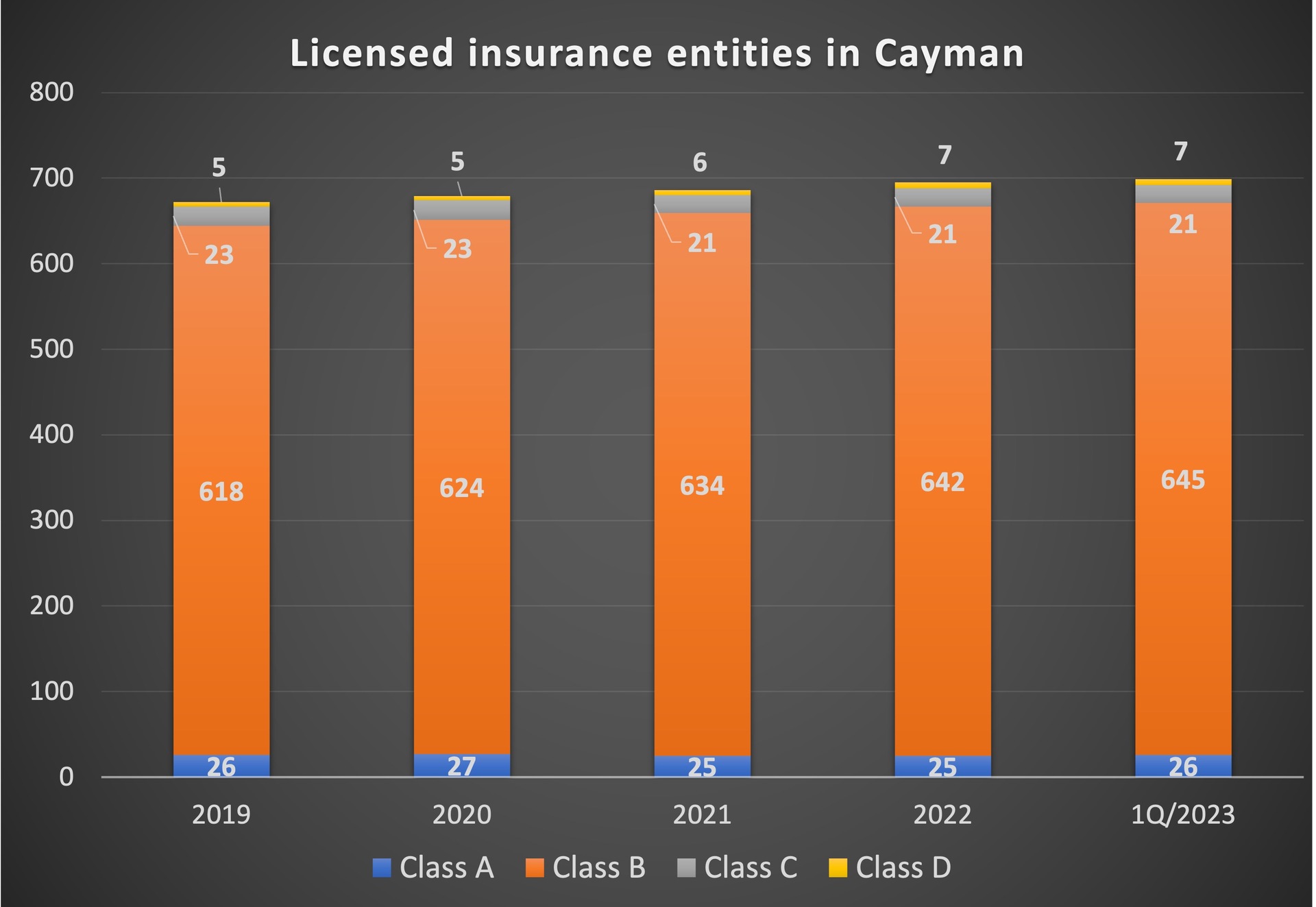

Following the addition of the new licensees there are now 673 Class B, C and D insurance companies licensed in Cayman which is a slight increase in numbers from the year-end of 2022.

Overall the insurer’s written premiums stand at US$28 billion and total assets are at $87 billion.

The Insurance Managers Association of Cayman (IMAC) said growth came from various industries including transportation, financial (life and annuity) and physician groups.

The growth also includes new heterogeneous group captives as some existing captives have spun off members from larger captives. One has taken the opportunity to create a specialty niche construction group which is viewed as higher risk, IMAC said.

Elaine Tapp, EVP Atlas commented that “at least one of our new clients chose Cayman over the U.S. as they wanted to diversify their political risk profile.

“Given the operating companies are US-based they were attracted to the stability and reputation of the Cayman Islands regulatory regime.”

IMAC said, the Cayman Islands continues to be well placed to attract new captive insurers as Cayman’s insurance manager’s report healthy pipelines.

In addition, a number of Class D, open market reinsurers, are expected to launch in the coming months.

New licensees in the first quarter included three B(i)’s, three B(iii)’s and two Class C’s along with one new Portfolio Insurance Company (PIC).